The problem here is the guy running the place

All Heck Breaks Loose amid Fears of Another Currency Crisis after Turkey’s Central Bank Governor Got Sacked Following Shock-and-Awe Rate Hike

After four months of relative calm, the Turkish lira is once again doing what it does best: slumping against every major currency. It nose-dived 17% overnight to near all-time lows, hitting 8.39 against the dollar and 9.97 against the euro before recovering later on, ending the day down over 7% against the dollar, amid concerns that the central bank and state-owned banks cushioned the fall by selling dollars into the market, thereby further depleting Turkey’s already scarce foreign currency reserves. The lira has lost half of its value since its currency crisis began in 2018.

The Borsa Istanbul Index suffered one of its steepest selloffs in years, before triggering circuit breakers that halted trading. The BIST 100 Index ended the day down 9.8%. Yields on Turkey’s lira-denominated 10-year bonds soared from 14% to 19%, as investors rushed for the exits. Investors also dumped shares of European banks with close ties to Turkey. Spain’s BBVA, which owns around half of Turkish lender Garanti, tumbled 7.5%, its biggest fall since November.

Mr.Copper

I don’t like to think of how many immigrants are on their way. It’s going to be a disaster!

… and I don’t blame the immigrants at all, I blame the politicians.

Rhodium $29,400 per Ounce, Like Diamonds? A lot Of Money In A Small Spot

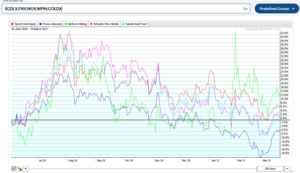

They show a chart here: https://www.moneymetals.com/rhodium-price

Five ounce bars, $54,487 each:

https://cbmint.com/baird-mint-5-ounce-rhodium-bar

Can you imagine waiting for that $54,487 thing in the mail? 🙂

Morning Buygold

I’d love to see some dividends and more cos selling their own metal! Re: First Majestic … I think I read the other day that they had decided to buy back their own stock. Would have been nice to see some cash flowing into our pockets instead.

You may be right about the miners not believing their good times. Just like us they are accustomed to the cretins smacking them down.

Cheers

Buygold

I have a better idea since they lie about the CPI and real inflation numbers by A LOT which keeps gold down miners should not only produce and sell gold directly avoiding middle man scams stealing profits for themselves during demand but increase dividends based on not just price but sales and profit like any company instead of discount prices to devalue prices. I can see what their claiming that they see inflation coming so they raise premiums so they don’t lose money but a poor excuse. They are speculating and taking equity from our futures in the phyz on current prices and its holding prices down by discouraging buying. That’s no better than a car salesman selling a car for twice the price now than it would be 25 yrs from now. Do banks have to pay those premiums? Then the investors and company wouldn’t be at the mercy of manipulation as much anyways even if the banks, fed, or China quietly buying it up if investors profit off sales. But then again would the gov make a deal to fix those numbers? Fake inflation numbers still need to be called out. Let’s see the real then and now numbers comparison of prices. How much was a GM 30 yrs ago Mr Copper likes to mention compared to now then why is the inflation number so low compared to real prices. A cup of coffee then and now.

Morning Ipso

No doubt fundamentals are really good for most miners. They all should be doing what First Majestic is doing as you mentioned the other day – selling their own metal. OR, they should be rapidly increasing dividends as prices rise.

In terms of dividends they are probably petrified that the paper scum is going to take the metals down again.

I hate these flatline bounces, they always seem to resolve in downside moves.

Maddog @ 10:33 re your: “they pretend it is the economy, when everyone knows, it is the money printing” Re Dow SnP NAZ ETC

Exactly right. Because the market cap of all the miners is so microscopic, compared to all other stocks, its better to guide or lead the hive into a much much bigger sand box to blow up rather than ours little sand box. Geez if that big indices MOB tried to fit into PMs it would be tulipomania all over again. We would come and go in three years and look silly.

part of link

“Today, the tulipmania serves as a parable for the pitfalls that excessive greed and speculation can lead to. ‘tulipmania’ was one of the most famous market bubbles and crashes of all time. At the height of the market, the rarest tulip bulbs traded for as much as six times the average person’s annual salary.”

https://www.investopedia.com/terms/d/dutch_tulip_bulb_market_bubble.asp

Quite a bit of green in the PM shares now

C’mon baby 7 come 11!

Maddog @ 10:33

You wouldn’t think so! They’ve been manipulating prices for far too long. I can’t wait til the rig blows up in their faces!

Cheers

Gold miners’ Q4 2020 fundamentals

The gold miners’ stocks have suffered an extended correction in recent months, leaving them deeply out of favor. Yet their underlying fundamentals remain incredibly strong, thanks to continuing high prevailing gold prices. These companies’ recently-released Q4’20 results revealed they are thriving, generating massive revenues, earnings, and operating cash flows. Thus their stock prices need to mean revert way higher.

Ipsofacto

The scum can’t keep letting the SM go higher and higher, driven by inflation only, even if they pretend it is the economy, when everyone knows, it is the money printing……and still sit on PM’s as the whole world will eventually see prices as too cheap and move in…..

treefrog

The Apes are gonna drive that Silver premium insane……

Silver demand outrunning supply … prices going down …

All’s well in Scum Reality.

Aquila check your inbox

Still having trouble?

treefrog

“I am ape.” Hear me roar! ![]()

Maya … BTW … :-)

US has ‘secret evidence of UFOs breaking sound barrier without a sonic boom and performing moves humans don’t have the technology for’, says Trump’s Director of National Intelligence

comex silver

there is a growing disconnect between comex silver prices and…

1) physical silver prices,

2) silver mining share prices,

3) reality

i am ape!