Philippines lifts nine-year ban on new mines to boost revenues

Philippine President Rodrigo Duterte has lifted a moratorium on new mineral agreements imposed in 2012, reopening the door to investments in a move that will boost state coffers but has dismayed environmental activists.

The Philippines, the top supplier of nickel ore to China and a major producer of copper and gold, imposed the moratorium while the government worked on legislation to boost the state’s share of mining revenues. Since 2018, the excise tax on minerals has doubled to 4%.

SIGN UP FOR THE COPPER DIGEST

Duterte’s new executive order allows new mining deals and reviews of existing contracts for possible renegotiation. It also directs the environment ministry to formulate terms and conditions and to strictly implement rules on mine safety and environmental policies.

Philippines lifts nine-year ban on new mines to boost revenues

Buygold @ 19:41

With all that money they’re making maybe they’ll increase the dividend. Yahoo says they’re paying 3.34%. I guess that’s not too bad at this time.

@ipso facto 19:20 Larora

Ok good thanks for the info. I added it to my list. I did very good with BTG and DRD before the correction. And SBSW. When they started to go choppy lateral I sold and got good divs too. I’ll be buying them back if AU AG keeps doing good

Thanks Ipso

Own a bit of BTG, hoping those earnings boost the stock.

Tomorrow is the tell

Do we get creamed and go back below $1750 or do we get follow thru?

Inspiring minds want to know.

Mr.Copper @ 17:20

Karora found too much gold to be called a nickel company. I’ve owned them for 6 mos or so. I like Australian plays, lots of gold there.

Karora Resources Photo Looks Like The Same Guys On The Royal Nickel Video

Strange it wasn’t up today.

@ipso facto re Karora Resources Inc., formerly Royal Nickel Corp

So I searched Royal Nickel and found this related impressive video, but from Oct 2018. Its strange this old video fits the recent news?

Start:

Talks about the company’s once-in-a-life-time gold find of a boulder with 9000 grams of gold per tonne resulting in a find of 24,000 ounces of gold. The project site was initially purchased as a nickel mine with gold exploration potential and features vertical shears mineralized with gold throughout the property.

The initial discovery will result in approximately $35 million for the company and Royal Nickel announced warrant exercises this week that are expected to raise an additional $8 million for the company’s treasury. In addition, the project’s cost of production is very low because of the high concentrations of gold. As a result, Royal Nickel is now fully financed to continue its exploration and drilling programs.

Profile:

Karora Resources Inc., formerly Royal Nickel Corp., is a Canada-based multi-asset mineral resource company. The Company is focused primarily on the acquisition, exploration, evaluation and development of precious metal properties. It is focused on gold production in Western Australia. The Company’s operations include Beta Hunt Gold Mine and Higginsville Gold Operations (HGO). The Higginsville Gold Operations includes a 1.4 million tons per annum (Mtpa) processing plant, approximately 192 mining tenements including Baloo, Pioneer, Fairplay North, Mitchell, Wills, Challenge and Mount Henry deposits. The Beta Hunt Mine, located approximately 600 kilometers from Perth in Kambalda, Western Australia, hosts both gold and nickel resources in adjacent discrete mineralized zones.

Chicago to release body cam footage of 13-year-old’s death

COPA agreed to release the video at the request of Toledo’s family, who got a first look at the footage on Tuesday. A statement from the law firm representing the family said the “experience was extremely difficult and heartbreaking for everyone present and especially for Adam’s family.”

City policy requires that body cam footage be released within 60 days of an incident. COPA also plans on releasing third-party video of the incident, ShotSpotter recordings, Office of Emergency Management and Communications transmissions, as well as use of force and arrest reports.

@Buygold @Maddog re The Fed’s Constant Money Creation To Buy Bonds To Keep Rates Low, To Avoid or Delay, A Coming Financial Catastrophe

You both make sense. But this is a very complicated puzzle. It seems to me like the system is trying to deflate, faster than the excess money creation can keep things inflated.

Because not enough money is going where it needs to go. Private sector small business profits, then to the small business employees, so high school graduates, and young people with unlimited wants and needs can pay high taxes and plenty left over for savings.

Like it was before 1970 when our businesses did NOT have foreign competition, we made everything here, and we had a budget surplus in 1969 before all the smelly Toyotas, Hondas Sonys Shoes Sox Under ware and ratchet sets and can openers started coming in. I noticed it first started between ’64 and ’66.

Like I posted after the 2008 crash, and Bernie Madoff getting caught, “If you were getting away with something, for a very long time, you better stop before you get caught.”

Well, Bernie was the first, and the Fed might be the last victim of their own making. I see them going for broke. Throttle up, nothing to lose. Point of no return going down the runway.

So the most important question in my mind, is if the end game starts unfolding, and everybody is cashing out, where to put the money? And how much time to do it. Real estate? Dollars? Gold Silver?

Sometimes before a bankruptcy the debtor enjoys himself, he’s resigned, he knows its the end, no hope, so enjoys spending the money that is supposed to go to suppliers and vendors etc. Then after the bankruptcy, they change names and have a fresh new start.

I know a guy that wasn’t paying his mtg for 6 years. He was buying silver coins and treating himself to his hobbies etc, and ended up getting a loan and buying a house. Wouldn’t it ironic if the new US Dollar gained enormous value, and ended up to be the best receptacle.

Poll Results …….The optimistic viewpoint becoming more likely …

The Precious Metals and the PM shares bottomed and the dollar topped out at the end of Q1

Yes (43%, 20 Votes)

Probably (32%, 15 Votes)

I have no clue (21%, 10 Votes)

Probably not (4%, 2 Votes)

No (0%, 0 Votes)

Total Voters: 47

?

Nancy Pelosi and senior Dems kill their own party’s bid to pack the Supreme Court with four more liberal judges by saying they WON’T support House bill

Mr.Copper

The old wisdom said the Fed/CB’s couldn’t control long rates, only short term ones……since the ’07/’09 crash, they have managed to keep rates low, mainly by buying their own debt sales….that cannot of course go on forever….my guess is they use Futures mkts, just like they use them in the PM’s to also keep rates low…..

But can they really keep them down here while printing like lunatics…it has never been done before…. when rates break free the Fed is ‘effed to put it simply.

Coinbase rolling over, wonder if Bitcoin will follow?

Would sure like to see some of those Bitcoin profits come into pm’s.

Mr. Copper – the only think I think is that the Fed has to keep rates low so the Gov’t debt can be serviced.

If rates go up, everything crashes.

Figure This One Out

My son signs up for a fraud alert for his credit card. Exactly two days later, he gets an a fraud alert re $200 from a Staples store. So he calls the credit card company, she was a little evasive with details, and they issue a new card, that FedEx delivered.

Maybe its another “make work” thing. He clicks, then the bank employee has to do something. Then a Fed Ex guy has to do something, then my son has to do something again, open the package. Now he has to update his on line paying.

@Maddog @Buygold re Higher Rates Since August, but Lower Lately

Rates have been net ziz zag lower since 1981. Meaning the Bond has been climbing zig zag higher since 1981. So all we can do is look at the charts and take a guess on the future of rates. Every dip on the way up, below, is a rise in rates.

10 Year Bond from ’82: https://www.mrci.com/pdf/ty.pdf

Higher Rate since August: https://schrts.co/RCyuQHpS

Things must be pretty bad for them to be saying and doing what they have been doing. Its crazy whats been going on.

Buygold

Re Rates.

I agree re Fed, they have more than likely ‘nudged’ rates down which is triggering the short covering, but as I said once that is done, who is going to go short ( bet rates are dropping) other than some trend followers….rates will soon be backing up again, with only the scum on the other side.

In PM’s I think we hold….signs of bull break outs in shares

What’s the verdict?

Are we going to fade into the close and give most back like last Friday or will we going to hold steady?

I’m conditioned to expect the worst. ?

@Maddog re Rates Should Be Higher

That’s right, everybody thinks rates should be higher, because historically going back to 1913, they always WERE higher, until…Drum Roll….the end of the trend, financial crisis of 2008.

Ya know? They had to know they made a mistake by 1929 causing 1934 and 1937. Then by 1964 they got another hint, and had to remove Silver coins from circulation. The next hint of a big hint of mistake, was 1971, when they were forced to remove Gold backing on the US Dollar.

Then by 1982, their great Fed Res system was so distorted they had to put interest rates up to 21% and so “hard up” they could not afford to make Copper pennies anymore. They were costing .13 cents each to make in ’82. Just one problem after the next since 1982.

After three generations of financial leadership, they have a very complicated situation on their hands, and they are not as smart as their grandfathers in the 1930s they did what had to be done. The Minimum Wage and Maximum Hours act of 1937.

They probably need to bite the bullet and do it again. Maybe globally, but the “wage” can’t be defined in currency. In each region it would have to be defined in “room and board” costs. Just like utility prices are determined in production cost in that region, instead of “fixed” currency minimum.

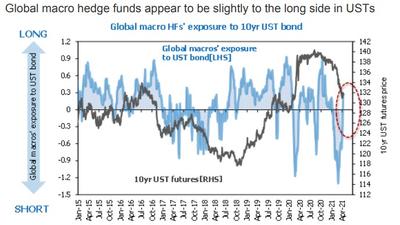

Maddog – ZH says short covering, I think the Fed is forcing the issue

…fundamentals-oriented global macro hedge funds and technically oriented CTAs as well have been covering short TY positions.

Rates

strange that they are falling…..but they are way overdone to the upside technically, lots of people looking for this correction…..but I wonder if many will really buy, apart from those trading the correction….as everything else say rates shud be going up.