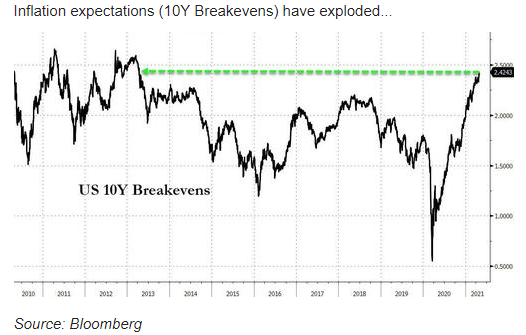

inflation expectations:

Real yields are flat to lower recently, supporting Gold’s move off its lows. While Powell says rising inflation is temporary, all evidence is to the contrary. While yields cannot be allowed to get out of hand and risk the collapse of everything, inflation will continue to rise as the printing presses remain plugged in and supply chains break down. This is the foundation for the coming surge in precious metals. I don’t see the 30-Year T-Bond going beyond the 2.75-3.00% resistance zone.

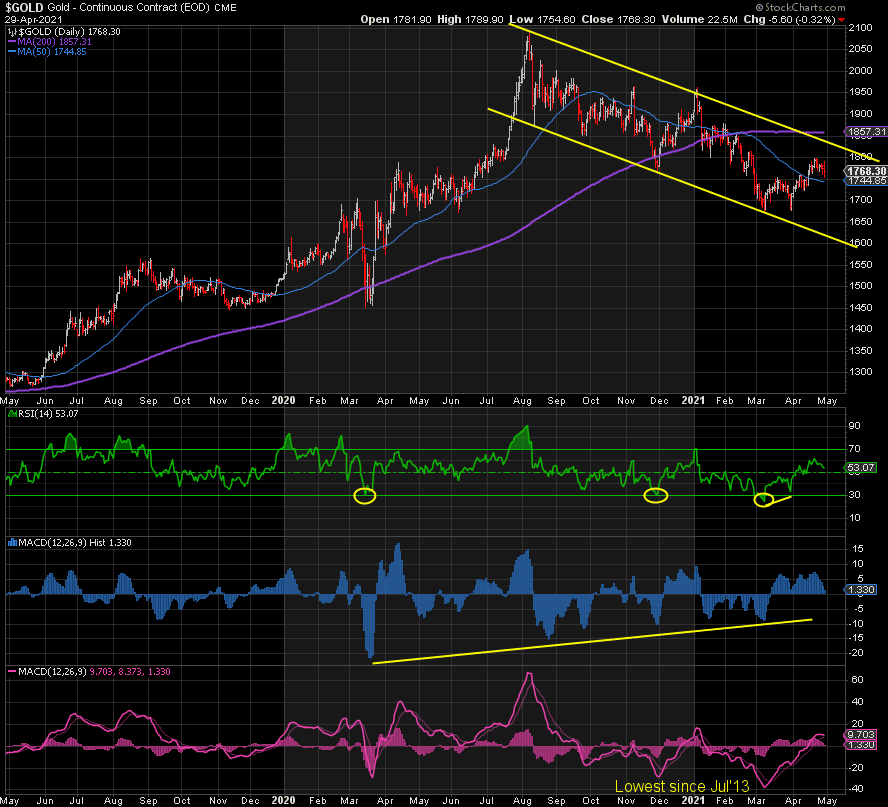

As long as Gold holds 1740, where the 50-day moving average also happens to be, a break of 1800 could signal take off. Confirmation would be a sharp move up through the 200-day moving average. In the meantime, don’t spend all day looking at the price going sideways. Wait for a break one way or the other.