Posted by Richard640

@ 10:15 on June 28, 2021

Could be an inneresting day….

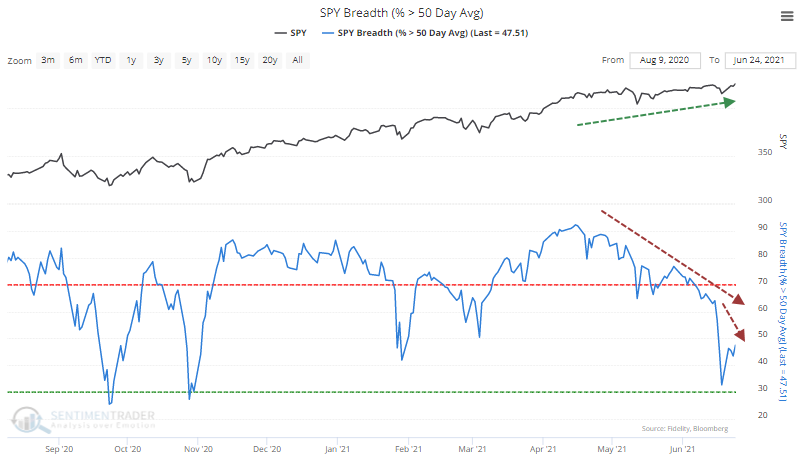

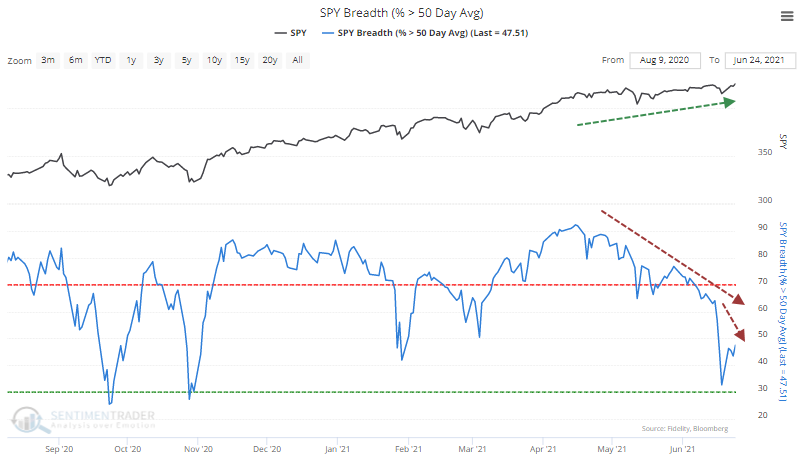

SENTIMENT TRADER

This Led to Declines Every Time in the Past 93 Years

There is some weird stuff happening under the surface of the market.

Early last week, the percentage of S&P 500 members above their 50-day moving averages had plunged, even while the majority were still above their 200-day averages. That has tended to be a good sign.

But…

The problem is what’s happened in recent sessions. Despite a push to new highs in the S&P toward the end of the week, the percentage of its members above their averages barely budged. In terms of divergences, this one is gonzo.

Going back to the mid-1920’s, there have only been a handful of dates with breaks like this. It happened in 1929, 1959, 1963, 1972, 1998, and 1999, and all of them ended up preceding losses in stocks.

Several more days (or weeks) with this kind of behavior should trigger all kinds of risk warnings, the types of things we’ve been watching for since speculation reached its heights in February.

Posted by silverngold

@ 10:11 on June 28, 2021

Posted by Buygold

@ 10:05 on June 28, 2021

If we can just get the USD to rollover we might have a chance.

Regardless, it’s still like pulling teeth to get the shares to move.

Posted by ipso facto

@ 9:56 on June 28, 2021

John McAfee ‘left SUICIDE note in his pocket’ before ‘jail hanging’ – but last words to wife were ‘I’ll call you later’

https://www.the-sun.com/news/3159316/mcafee-left-suicide-note-before-jail-hanging/

Posted by ipso facto

@ 9:52 on June 28, 2021

“CA beats NY”

I’m grokking on that. LOL

Talking to my Bro yesterday, he’s getting out as soon as he retires. Minden or Gardnerville on the NV side of the mountains look like a good bet.

Supposed to be 112 here in Oly today. Ridiculous!

Posted by ipso facto

@ 9:48 on June 28, 2021

McEwen Mining Files Early Warning Report

https://finance.yahoo.com/news/mcewen-mining-files-early-warning-171000347.html

Rupert Resources Reports Results for 12 Months Ending February 28, 2021

https://finance.yahoo.com/news/rupert-resources-reports-results-12-183600906.html

Azimut Explores 60 km of Greenstone Belt Hosting the Patwon Gold Discovery, James Bay Region, Quebec

https://finance.yahoo.com/news/azimut-explores-60-km-greenstone-103000687.html

Karora Announces Three Year Production Guidance and Organic Growth Plan to Double Gold Production to 185,000 – 205,000 oz by 2024

https://finance.yahoo.com/news/karora-announces-three-production-guidance-110500739.html

Eskay Mining Commences its 2021 Drill Campaign on Its 100% Owned Consolidated Eskay Precious Metal-Rich VMS Project

https://finance.yahoo.com/news/eskay-mining-commences-2021-drill-120000466.html

Amex Drills Highest Grade Assay at Perron – Reports 79.22 g/t Gold over 6.15 Metres Including 929.24 g/t Gold over 0.50 Metres at the High Grade Zone of Perron

https://ceo.ca/@accesswire/amex-drills-highest-grade-assay-at-perron-reports

Terreno Resources Reports Precious Metals Values up to 22.8 g/t Gold and 1,056.0 g/t Silver at the Las Cucharas Gold and Silver Project in Nayarit, Mexico

https://ceo.ca/@thenewswire/terreno-resources-reports-precious-metals-values-up

Phoenix Gold Announces High-Grade Copper and Zinc Surface Rock Samples at its York Harbour Mine Property Including up 16.8% Copper, 30.4% Zinc, and 119.6 gpt Silver

https://ceo.ca/@thenewswire/phoenix-gold-announces-high-grade-copper-and-zinc-surface

Posted by Ororeef

@ 8:05 on June 28, 2021

Posted by goldielocks

@ 2:01 on June 28, 2021

Still Calif beats NY and currently now few other cities. I’d rather buy a generator and deal with power out then that wackado Mayor and Gov of Ny and the corrupt judicial system there or should I say one of the most corrupt.

You know they’re planning to go after Trump again. What’s been allowed to go on is just plain evil. That whole system needs to be cracked open. The devil and God can’t be in the same place.

I almost took a picture this evening but too dark of a big banner on someone’s house that said Biden Sucks.

I currently don’t see anyone who votes Demo bragging about all the good things he’s done. They think they can just turn off the news and make it all manically go away.

Although there’s people on the right doing the same. Not that their eyes are closed but hearing about Biden, Kamila and demos just making them physically sick.

Posted by Maya

@ 1:51 on June 28, 2021

Pennsylvania Railroad’s ‘Broadway Limited’

prepares to depart Chicago

https://railpictures.net/photo/764351/

Posted by goldielocks

@ 1:40 on June 28, 2021

‘Honey, the pool is caving in’: Woman says sister was on phone to husband as she stood on collapsed Miami building balcony | US News | Sky News

https://news.sky.com/story/miami-building-collapse-relatives-of-the-159-missing-searching-for-answers-and-accountability-12342076

Posted by goldielocks

@ 1:09 on June 28, 2021

I read something very quickly earlier. A woman was standing on the balcony of the building talking to someone on the phone. She said that the pool was sinking and the ground was shaking then the person heard a blood curdling scream and her phone went dead. I’m hearing nothing about a sinking pool. If there’s a sink hole around there it’s fearfully possible other buildings are in danger.

Meanwhile another woman said she felt shaking and saw a crack forming in her wall about 2 inches wide. She ran to the stairs which is smart she didn’t get in a elevator and headed down and the building was starting to crumble. She said some people helped her get out in time that worked there I think and they thought it was a earthquake. She said if she would if waited another minute she wouldn’t of made it out.

With two warnings and descriptions like that it doesn’t seem like a sudden explosion.

Posted by silverngold

@ 20:12 on June 27, 2021

Posted by ipso facto

@ 18:14 on June 27, 2021

Posted by eeos

@ 15:48 on June 27, 2021

Now we are responsible for large private building’s safety bills too? This smells like BS. If a large building should be covered, my small house should be too. I need free money for repairs too. Sounds like a slippery slope sir. The fact of the matter is this, when building owners can’t afford repairs we CONDEMN buildings. They get the wrecking ball or blast charges, flatten and hauled away.

Posted by ipso facto

@ 15:24 on June 27, 2021

Yep lots of people in CA don’t deserve it … at least 40 or 45% who didn’t vote Democrat. The rest of them … you make your own bed …

Posted by Ororeef

@ 14:59 on June 27, 2021

probably that half of those missing werent there..my reasoning is many were foreigners and I think there would have been more rescued if they were there ….but we will never know ..WE do know the building had safety problems …Its just like the Government ..they know the infrastructure is crumbling but they money being spent is going for anything thats brings a VOTE instead of addressing the problem. Politics is so cruel and self serving ,we need to take public spending authority away from them ….The question then becomes ..were the tenants aware of the problem ? Were condos sold without full disclosure ? Its going to be a sad lesson when spending for infrastructure gets ignored. That includes large private buildings.The end results are very painfull. In California utility energy projects that cause fires are going to give a sad lesson along with water reservoir neglect is going to ruin Farms there …..Both of these will be catastrofic for California ..

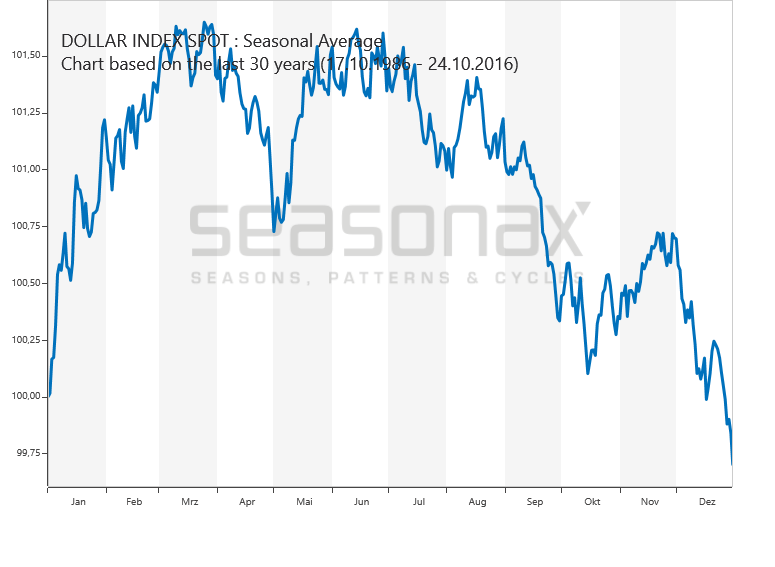

Posted by Ororeef

@ 14:31 on June 27, 2021

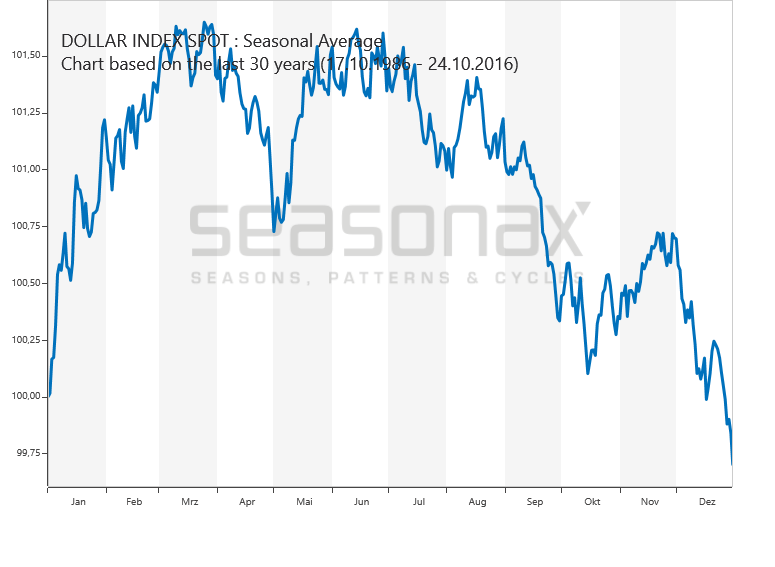

US Dollar Index

Source: Seasonax

For further information visit www.seasonax.com.

All information is supplied without guarantee.

|

Posted by goldielocks

@ 13:11 on June 27, 2021

I’m in no way downplaying the horrible collapse of a family building where I still wonder why they didn’t get cranes or something in there right away to remove heavy peace’s to at least get to the sounds of banging right away. It is indeed sad and tragic but:

It will have to be a pretty big distraction!!

Posted by Buygold

@ 12:12 on June 27, 2021

Goldie – you are right about those who chose to audit in AZ are patriots. Mike Flynn did an interview and said there will likely be a false flag to distract from the audit. I’m wondering if the building collapse in Miami could be the distraction.

Ipso – if I didn’t have family still in CA I’d say piss on them and their electricity. Unfortunately there are still a lot of good people in CA that don’t deserve what that corrupt government is giving them.

Posted by ipso facto

@ 11:10 on June 27, 2021

Even with the U.S.-Canada border restricting travel for at least another month, the international exchange of mining waste leaching from British Columbia into a transboundary watershed touching Montana and Idaho has continued unmitigated, intensifying concerns to such a degree that in the span of 10 days in June a rare confluence of global entities has paid heed to an environmental calamity that’s been brewing for more than three decades.

In a deluge of letters, stakeholders on both sides of the border recently articulated their concerns to top U.S. officials, including Secretary of State Anthony Blinken, whose office has been inundated with requests for federal intervention on the forested, river-braided boundary between B.C. and Montana. It’s along that boundary that the the Elk and Kootenai rivers converge in an impoundment formed by Libby Dam, called Lake Koocanusa, where rising levels of the mining byproduct selenium is resulting in adverse consequences for water quality, fish species and other aquatic life, the Flathead Beacon reported.

https://apnews.com/article/mt-state-wire-id-state-wire-montana-canada-lifestyle-9d39d3999c64478297b4c474d61f8d3f

Posted by ipso facto

@ 10:22 on June 27, 2021

Posted by Richard640

@ 10:07 on June 27, 2021

The debacle revealed that Wall Street mega banks were up to their old games again – secretly loaning out their balance sheets to hedge funds while simultaneously denying the public and regulators the ability to see the massive levels of concentrated risk. (See Archegos: Wall Street Was Effectively Giving 85 Percent Margin Loans on Concentrated Stock Positions – Thwarting the Fed’s Reg T and Its Own Margin Rules.)

According to the 13F filings that five of the largest Wall Street banks made with the SEC for the quarter ending December 31, 2020, they hold a combined $2.66 trillion in stock – either for themselves, their customers, or highly-leveraged hedge funds like Archegos. The breakdown is as follows:

Bank of America: $776.2 Billion

JPMorgan Chase: $680.6 Billion

Morgan Stanley: $647.47 Billion

Goldman Sachs: $388.6 Billion

Citigroup: $169.39 Billion

Each of these financial institutions also own federally-insured banks. JPMorgan Chase is the largest federally-insured depository bank in the United States. In addition to its common stock holdings, the federal regulator of national banks, the Office of the Comptroller of the Currency (OCC), reports that as of December 31, 2020 JPMorgan Chase is also sitting on $2.65 trillion in stock derivatives. As we reported in early April:

Posted by goldielocks

@ 8:41 on June 27, 2021

I just hope that they found what they were looking for in Az after so much time went by. We are lucky these patriots are out there fighting. We all know with all these ballots out there we can’t verify where they’re coming from and the left fighting agains ID and using the virus as the excuse there was trouble coming.

Then the fact that Trump was ahead by a lot everywhere and they stopped closed the doors and all of a sudden senile Biden suddenly got all these ballots days later and all the affidavits of witnesses seeing cheating going on.

I even seen on line watching both sides on the left a woman bragging how a relative left Florida went to Georgia to vote even though she was no longer a resident there.

Posted by Buygold

@ 8:40 on June 27, 2021

3- Why Basel III regulations are poised to shake up the gold market

Allocated gold, in tangible form, will essentially be classified as a zero-risk asset under the new rules, but unallocated or “paper” gold, which banks typically deal with the most, won’t — meaning banks holding paper gold must also hold extra reserves against it, said Brien Lundin, editor of Gold Newsletter. The new liquidity requirements aim to “prevent dealers and banks from simply saying they have the gold, or having more than one owner for the gold they have” on the balance sheet. Under the new regime, physical, or allocated, gold, like bars and coins, will be reclassified from a tier 3 asset, the riskiest asset class, to a tier 1 zero-risk weight Source: Marketwatch

- Takeaway 1: Buy Gold!

- Takeaway 2: Slow down, this has been known for years. Nobody is getting blindsided.

- Net-Net: Gold will appreciate annually more readily now, but volatility to the downside will increase as the industry consolidates. Cost basis will increase making it harder for smaller players to participate. This will be good for stackers, and big banks. ITwill be bad for leveraged hedge funds and smaller end user.

https://www.zerohedge.com/news/2021-06-26/gold-weekly-basel-iii-countdown

Posted by Buygold

@ 7:48 on June 27, 2021

He was classic. Went after Biden and the radical left hard as well as the corrupt elections and the RINO’s.

The audit in Arizona comes out tomorrow and is getting zero media coverage.

I’m hoping it causes an avalanche of audits if Trump ended up winning.