Contents:

Intuitively, it can be inferred that the Sharpe ratio of a risk-free asset is zero. Risk-Free Rate FormulaA risk-free rate of return formula calculates the interest rate that investors expect to earn on investment with zero risks, especially default and reinvestment risks. It is usually closer to the base rate of a central bank and may differ for different investors. The risk-free rate is subtracted from the portfolio return to calculate the Sharpe ratio. The result is then divided by the standard deviation of the portfolio’s additional return. William F Sharpe, the Nobel Laureate and emeritus professor of finance at Stanford University, instituted the ratio.

Therefore, an investor seeking to profit from mid-caps must exercise extreme caution. Usually, the value of mid-cap stocks is derived from their growth potential, but this growth potential does not always materialise. Compared to large-cap stocks, mid-cap stocks represent relatively young companies. However, with the right stock selection, investors could amass a modest fortune by investing in mid-cap stocks. Therefore, it becomes even more important to construct an optimal portfolio with mid-cap stocks. It is a very simple model as compared to the Markowitz model because it requires very few inputs (Bodie et al., 2020).

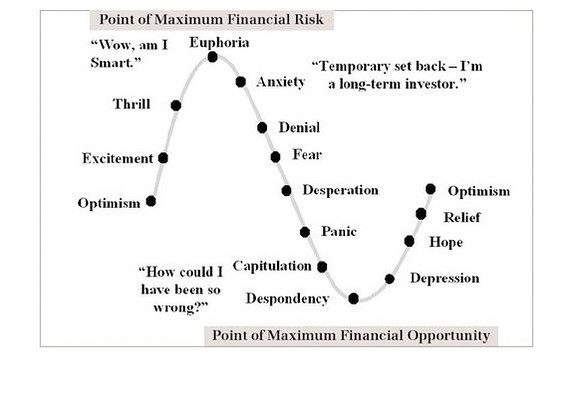

Over the short term, investment returns don’t follow a normal distribution. Market volatility can be higher or lower, while the distribution of returns on a curve cluster around the tails. This can render standard deviation less effective as a measure of risk. Sharpe ratio comes very handily to measure the risk-adjusted returns potential of a mutual fund.

Sharpe Ratio: Definition, Meaning, Formula, How To Use It

According to the model, it could be observed that the maximum investment of around 31.07 percent should be recommended in Metropolis Healthcare Ltd., followed by Varun Beverages at around 26.8 percent. 17 percent of the investment amount should be placed in Coforge Ltd., 12.02 percent in Trent Ltd., and around 7 percent in Aarti Industries Ltd. About 3.89 percent of the portfolio should comprise the stock of Astral Ltd. These six stocks would comprise around 97.9 percent of the portfolio. The remaining 2.1 percent is divided into the remaining five stocks namely Navin Fluorine International Ltd., Dixon Technologies, Laurus Labs Ltd., Godrej Properties Ltd., and Metropolis Healthcare Ltd.

- To continue with the example, say that the risk-free rate is 5%, and manager A’s portfolio has a standard deviation of 8% while manager B’s portfolio has a standard deviation of 5%.

- The Sharpe Ratio, developed by William F. Sharpe, is an effective way of benchmarking the investment return compared to the amount of risk involved.

- Investments with an abnormal distribution of returns can result in a flawed high ratio.

- Your obvious answer would be that Fund Y is better because it is giving 2% higher returns.

- Sharpe Ratio is also used to carry out the performance of a particular share against the risk.

Key criteria one should apply while choosing a mutual fund to invest inPicking the right mutual fund may look easy, but it cannot be done without following certain basic criteria. Before investing in any fund, you must first identify your goals for the investment. This shows that the addition of a new asset can give a fillip to the overall portfolio return without adding any undue risk.

The tracking error can be calculated by taking the standard deviation of the difference between the portfolio returns and the index returns. For ease, calculate the standard deviation using a financial calculator or Excel. The Nobel laureate, William F. Sharpe developed the Sharpe ratio, and it is used to help investors understand an investment return and the risk. The ratio reflects the average return received above the risk-free rate per unit of uncertainty or total risk.

It can compare two different funds that possess the same risk or same returns to help an investor understand how well he will be compensated. You’ve probably heard investing professionals talk about risk-adjusted returns. This is a way of measuring the performance of an investment that factors in risk—specifically, the extra risk required to get higher returns.

Sharpe Ratio vs. Treynor Ratio: What’s the Difference?

The investor believes that adding the hedge fund to the portfolio will lower the expected return to 15% for the coming year, but also expects the portfolio’s volatility to drop to 8% as a result. The risk-free rate is expected to remain the same over the coming year. For example, an investor is considering adding a hedge fund allocation to a portfolio that has returned 18% over the last year. The current risk-free rate is 3%, and the annualized standard deviation of the portfolio’s monthly returns was 12%, which gives it a one-year Sharpe ratio of 1.25, or (18 – 3) / 12. In contrast, financial markets subject to herding behavior can go to extremes much more often than a normal distribution would suggest is possible.

A good example of this can also be found with the distribution of returns earned by hedge funds. Many of them use dynamic trading strategies and options that give way to skewness and kurtosis in their distribution of returns. Many hedge fund strategies produce small positive returns with the occasional large negative return. For instance, a simple strategy of selling deepout-of-the-moneyoptions tends to collect small premiums and pay out nothing until the “big one” hits. Until a big loss takes place, this strategy would show a very high and favorable Sharpe ratio. The Sharpe ratio indicates how well an equity investment performs in comparison to the rate of return on a risk-free investment, such as U.S. government treasury bonds or bills.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia does not include all offers available in the marketplace. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

Move Over 60/40 – LoCorr Funds – Commentaries – Advisor Perspectives

Move Over 60/40 – LoCorr Funds – Commentaries.

Posted: Fri, 21 Apr 2023 07:00:00 GMT [source]

Your financial situation is unique and the products and services we review may not be right for your circumstances. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Performance information may have changed since the time of publication.

What does a negative Sharpe Ratio mean?

For example, Mr. Sharpe anticipates a 13% return on his portfolio in the coming year. He also knows the One-year US Treasury yield, which can be considered a risk-free investment, is 1.55%. Again, the Sharpe Ratio does not show where the risk is coming or the makeup of a portfolio. A portfolio that is concentrated in one sector can have a high Sharpe ratio, implying an optimal risk-return balance, while it has a high portfolio risk or industry risk. Hence, on a risk-adjustment basis, your portfolio offers a better return per unit risk. At the end of the day, every investor aims to maximize returns and minimize risk.

Moreover, as standard deviation contemplates positive and negative variability from the mean return, its measurement of the downside risk is inaccurate. Even in less extreme cases, a reliable empirical estimate of Sharpe ratio still requires the collection of return data over sufficient period for all aspects of the strategy returns to be observed. For instance, adding assets to a portfolio to better diversify it can increase the ratio. Investing in stocks with higher risk-adjusted returns can power the ratio upward. Investments with an abnormal distribution of returns can result in a flawed high ratio. For example, low-quality, highly speculative stocks can outperform blue chip shares for considerable periods of time, as during the Dot-Com Bubble or, more recently, the meme stocks frenzy.

Subtract the risk-free rate of return (one-year or two-year U.S. Treasury yield) from the return of the portfolio to get the excess return. It does this by using the standard deviation of excess returns only to the downside, instead of in both directions. But if a portfolio adds a high-volatility strategy that is negatively correlated, that added volatility can decrease the total volatility of the portfolio. Gold often rises in times of economic or political turbulence — times which often lead to downturns and higher volatility in equity portfolios. But our volatility measure has to be a positive number (a standard deviation can’t be negative), so returns below the risk-free rate are the only way to generate a negative Sharpe Ratio.

The implication of Sharpe Ratio

The outcome may indicate if the investor took on excess risk to achieve greater returns. Additionally, investors can use expected portfolio returns and the probable risk-free rate to predict the future Sharpe ratio. What Sharpe Ratio does is to measure the returns earned in excess of the risk-free rate of return and compare it with the risk taken upon investing in the security or portfolio. By viewing the excessive return in the light of the risk inherent in the investment, the investor can assess whether the return is worth the risk.

Suppose, if an investor is invested in a fund with a Sharpe Ratio of 2.00, adding other funds to the portfolio would help reduce ratio and risk factors. A high standard deviation means there is a huge difference between the principal returns and the returns of an investment. In simple words, the Sharpe Ratio adjusts the performance for the excess risk taken by an investor.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. A higher Sharpe Ratio will indicate a greater return proportional to the risk taken on.

But those call options are likely to outperform, and often with lower sharpe ratio meaning, precisely when volatility spikes in the rest of the portfolio. Obviously, no one would build an investment strategy with the purpose of generating returns lower than a short-term Treasury, generally considered one of the safest investments in the entire world. Beating the risk-free rate by 10 percentage points with a standard deviation of, say, 2.5 — a low-volatility result — suggests a Sharpe Ratio of 4 — an impressive performance. Hedge Fund B thus has a Sharpe Ratio of 1.2 — higher than that of Hedge Fund A, despite lower returns. The higher Sharpe Ratio suggests that Hedge Fund B offered better returns for its investors than did Hedge Fund A relative to the risks each fund took. On an absolute basis, Hedge Fund A has outperformed Hedge Fund B, which generated returns of just 12%.

Many such sectoral studies have also been conducted for Indian companies listed on the BSE and NSE (Ahuja, 2017; Anithadevi and Mallikharjunarao, 2017; R. and Reddy, 2022; Shriguru and Bagrecha, 2022). The purpose of the article was to examine the superiority and efficacy of Sharpe’s single-index model of portfolio optimisation. The study has attempted to build an optimal portfolio of Indian mid-cap companies using William Sharpe’s single-index model. A portfolio was selected from the Nifty mid-cap 100 index of the NSE.

Avantis Emerging Markets Value ETF May Be Heavily Undervalued … – Seeking Alpha

Avantis Emerging Markets Value ETF May Be Heavily Undervalued ….

Posted: Wed, 03 May 2023 14:24:48 GMT [source]

The benchmark used is typically an index that represents the market or a particular sector or industry. Considering standard deviation as a proxy for risk has its pitfalls. Standard deviation takes into account both the positive as well as the negative deviation in returns from the mean, hence it doesn’t accurately measure the downside risk.

Here’s a Better Way to Identify Quality Stocks – Institutional Investor

Here’s a Better Way to Identify Quality Stocks.

Posted: Thu, 20 Apr 2023 07:00:00 GMT [source]

A unique feature of mid-cap stocks is that they would be re-rated if they came under the radar of institutional buyers. Good mid-cap stocks would certainly outperform large-cap stocks as well as the market index in the bull run. Nevertheless, with the proper stock-selection skills and investment disposition, these stocks have the potential to generate very attractive returns. Despite the fact that mid-caps have a long history of strong returns, not all mid-caps are profitable investments.

Based on these calculations, manager B was able to generate a higher return on a risk-adjusted basis. The standard deviation in the Sharpe ratio’s formula assumes that price movements in either direction are equally risky. In fact, the risk of an abnormally low return is very different from the possibility of an abnormally high one for most investors and analysts.

The excess return over beta ratios was compared with the cut-off rates. The difference between the two metrics is that the Treynor ratio utilizes beta, or market risk, to measure volatility instead of using total risk like the Sharpe ratio. They can try to boost their risk-adjusted free returns by lengthening the time horizon for measuring the ratio. The Sharpe Ratio help’s investors to shed light on a fund’s performance. By looking at Sharpe Ratio, investors can carry out the level of risk of any fund in comparison with the extra returns.