1/7/2022

Governor Ron DeSantis to Biden Administration: Release Stranglehold on Life-saving Monoclonal Antibodies

Someone needs to get a message to The Governor to open up Ivermectin and the FLCCC protocol to the state and knock the power from the cabal right out of their hands and run with it. Problem solved Then lead the other states to do the same.

Nice to see

the shares not getting dragged down with the SM.

Pretty soon someone is going to notice the outperformance.

Now we’re talkin’

The very small crowd that has taken notice of our pm’s have finally stepped up to the plate. Hopefully that crowd becomes large and we get a “rip your face off” rally.

Would love to see the HUI close up around 260

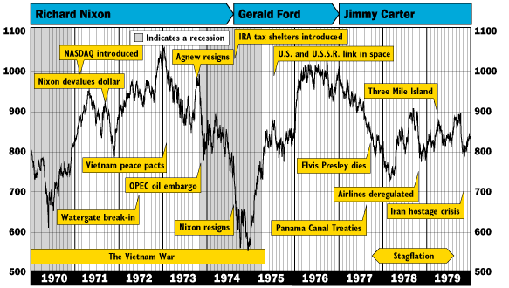

The Indices Peaking And Heading Lower Is No Different Than Gold Silver And CommodIties Peaking In 1980 And Heading Lower Until 9/11/01

The Indices and real estate these days was just a different inflation hedge for people to get rid of extra time-wasting asset of US Paper Dollars. Try to imagine how high gold and silver would be today if there were no paper alternatives like GLD SLV Futures paper etc for them, and no bit coins etc. They turned out to be false flags for Gold and Silver. But the Fed has to consider, or take into consideration, its the same thing that was going on in the 1970s US Dollar Dumping. I also remember many people were taking their money out of the banks even though they paid 18% five year CDs. Will the Fed be able to raise rates? Thats the $64 question

Commodity Bust Charts showing bottoms in 9/11/01:

Postscript Document (mrci.com)

https://www.bitchute.com/video/W1bzJPkfbecS/

BOMBSHELL! 3 MEDICAL WHISTLEBLOWERS: NEUROLOGICAL ISSUES UP 1000% FROM 82K TO 853K IN ONE YEAR!

These pm shares are about done going down

One turn in the USD and silver will do it.

Ororeef @ 6:33 Nice Catch On Lowest Point in 14 year crash Dow Jones Under 1,000 1968 to 1982

Oro, I was getting the Dinesletter when a mail gram came to my front door. In June 1982 Dow at 796. It said…”Mr Dines recommends selling all inflation related assets, and move into the Dow at 796.” He also predicted a deflation in labor costs due to the use of foreign labor. He was one of the first to use technical analysis charting. He was fired from his job for recommending miners when Silver was .92 cents and Gold at $35. May have been late ’50s or early ’60s. I read his book the “Invisible Crash” from 1975 I think. The story was if you didn’t go up and prices stayed flat, it was the same as a crash. Like wages that don’t keep up with inflation. In my area even the houses were flat 1968 to 1982. The poor slob that bought a house in 1968 on the highs, took a beating if he sold in 1982, after paying all the interest payments maintenance and property taxes. Rates were going up 5% to 18% on loans 68-82. The guy that bought that house in 1982 and sold in 1988 won the lottery as interest rates were dropping after 1982.

Story:

Not long after the industrial average punctured the 1000 mark, a recession occurred and the brutal bear market of 1973-74 set in, pushing the average all the way down to 577.60 in December 1974. It would be late 1982 — a full decade after the 1000 milestone was first passed– before the industrials rose above 1000 to stay.

Dow 1000: Finally in ’72

Cheers rang out on the floor of the New York Stock Exchange when the Dow Jones Industrial Average crossed the 1000 mark on Nov. 14, 1972.

If ever there was a psychological barrier for the Dow industrials, ”Dow 1000” was it. The average had knocked on the door of 1000 repeatedly for six years, but could never close above that ”magic” level.

For example, the industrials closed at 995.15 on Feb. 9, 1966, and at 985.21 on Dec. 3, 1968. There were also close calls in May 1969. But no cigar — until the euphoria of 1972.

Many investors active today will remember 1972. Richard Nixon was president, ”The Godfather” was packing them in at the movies, and Americans were tuned to ”All in the Family” on television. The Watergate scandal, which later destroyed the Nixon administration, was only a cloud on the horizon. The Vietnam War was a major problem, but on the day the 1000 barrier fell, North Vietnam had agreed that its representative would meet with U.S. negotiator Henry Kissinger for a new round of talks aimed at ending the war.

The re-election of Mr. Nixon over George McGovern had occurred a week earlier. And the economy was doing well. Economic growth was unusually strong, inflation was moderate and interest rates were low.

In the stock market, it was the heyday of the ”Nifty Fifty,” stocks that were so popular that it was said they were ”one decision” stocks: Buy them, and never worry about selling. Among the most popular stocks of the day were Xerox, Avon, IBM and McDonald’s.

deer79 @ 10:41

Thank you.

The Russians are not fools I agree they’ve been taking steps, buying gold etc to deal with the possibility of being kicked out of the swift system.

This would be a real stupid move I think but look who is running our government!

Ipso

Firstly; condolences on the loss of your sister in law.

As far as the UK/US threatening Russia by banning them from the SWIFT system……

I think there’s more to this than is being reported.

Perhaps Russia has been anticipating this potential move, and has been consistently buying physical gold the past few years, to counter this?????

LOL!

BIDEN ADMINISTRATION SAYS WORKING WITH UKRAINE TO MAKE SURE RUSSIAN FORCES SHOW VALID PROOF OF VACCINATION BEFORE INVADING UKRAINE

— Stalingrad & Poorski (@Stalingrad_Poor) January 24, 2022

Trending

Denmark to announce removal of all COVID-19 curbs: Report https://t.co/5mOrtUWHw2

— News of Emirates (@newsofemiratess) January 25, 2022

Under the cosh!

Australian miner plunges most since 2014 after Burkina Faso coup

West African Resources (ASX: WAF), an Australian gold miner that gets all its revenue from Burkina Faso, plunged the most in about seven years after soldiers ousted President Roch Marc Christian Kabore in a coup.

The shares fell 17%, the biggest drop since November 2014, in Sydney on Tuesday. The company produced 87,324 ounces of the metal in the three months through December, according to a company statement.

Australian miner plunges most since 2014 after Burkina Faso coup

No real mkt does this, only a scum mkt

has a bull break out, that gets crushed straight after……pure criminality.

Rio Tinto and Mongolia settle feud over Oyu Tolgoi copper mine

Rio Tinto Plc and the Mongolian government said on Tuesday they have reached an agreement to end a long-running dispute over the $6.93 billion expansion project for the Oyu Tolgoi copper-gold mining project.

The deal marks a positive development for the Anglo-Australian mining giant, which is reeling from Serbia’s rejection last week of its proposed lithium mine as well as local opposition to projects in Guinea, the United States and elsewhere.

SIGN UP FOR THE COPPER DIGEST

“It’s a major relief. It’s a huge step forward for us,” Rio Chief Executive Jakob Stausholm told Reuters via phone from Ulaanbaatar ahead of a flight to the mine site for a ribbon-cutting ceremony later on Tuesday with Prime Minister Oyun-Erdene Luvsannamsrai.

“We are very comfortable with this outcome and, more than anything, achieving a full reset of the relationship,” said Stausholm, who became CEO last year.

Rio Tinto and Mongolia settle feud over Oyu Tolgoi copper mine

This would accelerate the decline of the dollar IMO. Economic War?

UK PM Johnson says talking to U.S. about banning Russia from Swift payments system

Now we’re poppin’

Gold taking its first run at $1850 since last year.

We’re going to have another decent day in gold.

goldielocks @ 0:07

Thanks I may just do that.

Galantas Gold Enters Into Loan Agreement

https://finance.yahoo.com/news/galantas-gold-enters-loan-agreement-070000712.html

Lion One Reports Additional High Grade Results from Ongoing Infill Drill Program Including 359.8 g/t Au Over 1.8m Including 1616.0 g/t Au Over 0.4m, And 294.5 g/t Au Over 0.3m From near Surface at Tuvatu, Fiji

https://finance.yahoo.com/news/lion-one-reports-additional-high-080100368.html

Probe Metals Further Expands Gold Mineralization at Monique Trend, Val-d’Or East Project, Quebec

https://finance.yahoo.com/news/probe-metals-further-expands-gold-113000870.html

GALIANO GOLD REPORTS PRELIMINARY Q4 AND FULL YEAR 2021 OPERATING RESULTS FOR THE ASANKO GOLD MINE

https://finance.yahoo.com/news/galiano-gold-reports-preliminary-q4-113000133.html

Ascot Provides Update on Premier Gold Project Progress to Date and Plans for 2022

https://finance.yahoo.com/news/ascot-provides-premier-gold-project-120000436.html

Endurance Reports Remaining Drill Results from Reliance 2021 Program Including 5.71 GPT Gold over 5.6 M and 3.76 GPT Gold over 14.3 M

https://finance.yahoo.com/news/endurance-reports-remaining-drill-results-122000527.html

Aben Resources Receives Regulatory Approval for Deal to Acquire the Slocan Graphite Project and Provides Update on Forrest Kerr Property, British Columbia

https://finance.yahoo.com/news/aben-resources-receives-regulatory-approval-130000642.html

Snowline Gold Intersects 1.01 grams per tonne over 136.8 metres in First Hole Returned from Its Bulk-Tonnage Valley Discovery, Rogue Project, Yukon

https://finance.yahoo.com/news/snowline-gold-intersects-1-01-130000355.html

HighGold Mining Discovers New Regional Gold-Bearing Structure at the Johnson Tract Project Defining a Multi-kilometer Prospective Target Corridor, Alaska, USA

https://finance.yahoo.com/news/highgold-mining-discovers-regional-gold-131500755.html

Barrick’s Tanzania Mines Advancing to Tier One Status

https://finance.yahoo.com/news/barrick-tanzania-mines-advancing-tier-110000708.html

IAMGOLD’S Essakane Mine Continues Normal Operations Following Political Developments in Burkina Faso

https://finance.yahoo.com/news/iamgolds-essakane-mine-continues-normal-130000179.html

Equinox Gold Provides 2022 Guidance: Production Increasing to 625,000 to 710,000 Ounces of Gold

https://finance.yahoo.com/news/equinox-gold-provides-2022-guidance-120000199.html

SilverCrest’s Las Chispas Construction Update – Tracking Ahead of Schedule and On Budget

https://finance.yahoo.com/news/silvercrests-las-chispas-construction-tracking-120000996.html

ATAC Options Catch Copper-Gold Property, Yukon

https://finance.yahoo.com/news/atac-options-catch-copper-gold-130000176.html

Spanish Mountain Gold Reports Results on Environmental Assessment & Project Optimization; Sets Tangible Targets for 2022

https://finance.yahoo.com/news/spanish-mountain-gold-reports-results-133000479.html

OCEANAGOLD ACHIEVES FULL YEAR 2021 GUIDANCE ON RECORD ANNUAL PRODUCTION FROM HAILE

https://finance.yahoo.com/news/oceanagold-achieves-full-2021-guidance-110000686.html

personally I would put zero faith in that chartist people love to pull out from the early 2000’s

that used to frequent this site. Not gold hummer either. Let the guy fill cavaties like he was trained to do.

Little ugly out this morning

I guess the scum will have to mount another major offensive to bring things back.

PM’s doing what they’ve been doing – holding steady. The big problem is the shares – as usual – they trade with the SM. Silver is the tell again this am. Shares can’t move higher with silver falling. JMHO

edit: One more thing, the fact that the SM has gotten crushed and the data has slowed. What the hell is the Fed going to do? What will Powell say tomorrow during Q & A? JMHO, but if he tones down the Hawkish rhetoric and sounds dovish, the SM and I think gold too, will explode higher.

I remember the 1968 Bull Market ending very well

it took years for it to bottom.I was in cash from 1969 until Jan 1975 . I was busy starting a new business. I saw the bottom in jan 1975 and was walking into my office to call my broker Wesley when the phone RANG..A voice said Vincent do you see what I see ,Yes I do ..It was Wesley we had the same vision withen seconds apart after being out of stocks for some years.

“I got some ideas” he said..and that was the beginning of a 13 year Bull Market that ended for me in crash of 87..

I suspect this bull will take years to bottom just like then..PE ratios of dividend paying stocks were at 5 …A complete shake out!..I bought one stock in 1975 at $5.00 and they had $11.00 per share CASH in the bank …thats a real bottom.. Bottom fishing was the bargain of a lifetime…Its going to be a long way down probably take 7 years ..that is if the economy dosent go with it..then all bets are off…