The London Metal Exchange has introduced **emergency measures** in the aluminium, cobalt, lead, nickel, tin and zinc markets. Among them, the LME has set limits on the nearest-term spreads and allowances for holders of some short positions to avoid delivery of metal | #Ukraine pic.twitter.com/XROZxVFiMM

— Javier Blas (@JavierBlas) March 7, 2022

Paper burns?

Good thing Cliff High is here to save thousands of lives

even though he’s never saved one with his bullshite predictions. I predict this guy is wrong again, I’d bet my entire portfolio on it in fact

We have to be carful..,

Because we have a current administration that can’t foresee the consequences of their actions or inactions after living in a self serving bubble for so long or just don’t care.

They have a ability to start making chips here I heard that would give jobs to the mid west and boost American company’s but will they approve the funding or keep doing the wrong thing.

We have our own oil plus our neighbors in Canada right next store but instead they want to buy overseas raising the cost and energy more energy to transport and enriching terrorist.

With increasing shortages on commodities and them doing the wrong thing all the time I can’t see this getting better anytime soon.

Now their money making scheme between tech stocks and vaccines is over and their inability to do what right they are currently lost.

I just hope they don’t put us in a WW111 with their stupidity thinking they can take out Putin and XI without consequences because Schwab told them so but Armstrong is worried on what he sees on his computer.

Buygold 16:58 I did that backward lol

I’m thinking the same thing.

SM futures getting crushed tonight

Gonna be an ugly day tomorrow if this keeps up all night.

edit: OTOH looks like everything is down tonight, metals and even oil is taking a pause.

FWIW….

Clif High has an idea that “zero day” is approaching – 3/11.

I lightened up a little today, probably exactly the wrong time but…

The SM looks like it’s going to crash to me, I’m not sure if that will hurt pm’s though. I would think the HUI might pause at 320. Regardless of the HUI, gold doesn’t look like it wants to go down and any dip probably should be bought.

Looks like gold may be the last commodity to really get going.

With the way the SM is acting, I suspect that the financial war we’re having with Russia may have some implication for world credit markets.

Re The News? Globalization Was The Biggest Mistake Worst Decision Ever Made

Now everybody is finding out. So thats good. And trying to modify the climate??? Thats another dumb as a stump idea. Our Founding Fathers said to avoid foreign entailments. Wave to your neighbors, don’t marry them.

And look how all those various weak and strong European countries got merged into one. Imagine how industrious Germany felt getting merged with Greece?

And regarding all the people fleeing Ukraine on the news, all speak English? Whats with that? Like Afghanistan? All the people fleeing must have felt they weren’t wanted there? And why would Ukraine go against Russia? Did they have rocks in their head?

I always thought Russia and China were allies. Now it sounds like Putin and Russia sounds like Saddam Husein and Iraq, and Russia needs a regime change. LOL Was there a regime change in Ukraine we never heard about?

https://www.bitchute.com/video/KRMyiYprBKKT/

AUSTRALIAN HEALTH OFFICIALS SAY THEY ARE CONCERNED THAT VACCINATED PEOPLE ARE SUDDENLY DYING

1 minute video confirming what we already know.

https://www.bitchute.com/video/PAla4j55PC4q/

THE SHOCKING DIFFERENCE BETWEEN VACCINATED AND UNVACCINATED BLOOD.

In case you had any doubts!

The Snowflakes think they can punish Vlad for being a bad man, not a nice man and the Davos crew A: hate Vlad

especially Obummer and B: need a Covid distraction….so lets all pile on Vlad, any old way……except that did anyone check the CFD possies of all our favourite crooks the Banksters ..

According to Wall st on Parade there are a straight $ 41 billion of CFD’s on Russian Sovereign Debt…but what about the Corporate debt and other debt…err not sure ….but safe to say it ain’t chicken feed and the performance of Banking shares…..says there is something very smelly on their books….again….like multi billions ….

The Big Question on Wall Street Is Which Banks Owe $41 Billion on Credit Default Swaps on Russia

Alex

You should call up the broker and not talk to the phone handlers they’re ideally useless. I can imagine the trouble even if you did have a phone and it wasn’t working or you changed your number.

Maddog 8:08

I agree confiscating property of private citizens is outright theft.

Maybe Putin should confiscate Hunter and all the other politicians kids associated with Ukraine companies accounts including “ the big guy.”

Shares are ripping

PM’s starting to get some traction. Gold taking another run @ 2K?

Silver needs to get going.

I hope For Ukraine

But it’s not going to stop inflation in this country anyways.

Chile a step closer to nationalizing copper and lithium

Chile’s constituent assembly, in charge of writing the country’s new Constitution, approved on Saturday an early-stage proposal that opens the door to nationalizing some of the world’s biggest copper and lithium mines.

The motion by the environmental committee, which gathered over the weekend for the first time since its creation as a deadline to wrap up proposals looms, received 13 votes in favour with three against and three abstentions.

The proposal targeting mostly large-scale mining of copper, lithium and gold has yet to be approved by two thirds of the full assembly to become part of Chile’s new charter, which will be put to a national referendum later this year.

Alex Valdor @ 9:22

Ameritrade has worked pretty good for me.

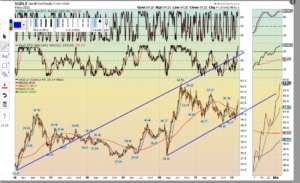

If we take out todays Hi’s…hrly chart say we could explode higher.

just done a nice 3 wave pullback.

a new century…

the democ rats will look back for years on the sleepy joe / kamaltoe administration, much like the republicans looked back all through the ’30s and ’40s on the hoover administration. the democ rats’ policies have wreaked so much havoc on the u.s. economy that their memory will be a stench in the nostrils of a generation.