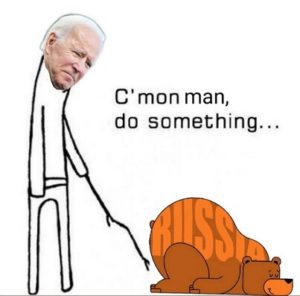

Canada Says Its Oil Could Replace US Imports Of Russian Crude, All It Would Take Is Approval Of The Keystone XL Pipeline

HUI – 321

Maybe we’ll blow through that too. They are just reflecting the rising go pm prices and that could stay overbought for awhile.

edit: gold up $50!

Mr Cooper

5 dollars could be easily achieved this year. Biden is banning oil and might get it from Venezuela and if they do I hope they negotiate to get our citizens out. They have a ex green beret and Us oil company people locked up and who knows who else.

That’s crazy in price. You really should have a alternative in that kinda cold anyways. Maybe get a wood stove. Maybe even a few electric heaters would be cheaper to cut down on its use.

Well shux

maybe an up day of $50 might not be a fantasy after all..

Silver up a buck? Is that real??

Nickel? Try Coinflation.com for the Five Cent coin

Nickels might be worth more than 5 cents. The pre ‘82 Copper pennies are worth more than a penny. 140 copper pennies is a pound of copper . Check the price of copper rounds. Or bar and tubing stock at ace hardware.

Ipso

No way, I’m not buying it but will buy something else instead later.

I wanted to pick up some SlV today but the darn thing gapped up. Hopefully it will try to fill the gap tomorrow. Now I know what they mean by trying to grab the bull by it’s horns.

goldielocks @ 3:42

Quite a spike in nickel! I don’t know how you can buy something like that now.

@Goldilocks

Right on that. The earlier deliveries were less so far I’m up to $4100 hopefully the last delivery for the winter. I’ve had worse years like $5 or $6,000 when oil was $145/bbl.

The $145/bbl days the dollar index was 72. 2008? We’ve got $125 oil with a very high dollar index over 90. If the dollar drops back towards 80 things will get very interesting with oil gold silver etc.

All metals were too cheap for too long. Never kept up with inflation 1965 to 2004. I used to make things out of metals and remember . Everything is in reverse after 9/11 and Bernie Madoff.

Distortions and oddities are trying to right themselves it seems. The biggest important one is the starter wages were not keeping up also 1975 to present.

The biggest thing on bills is labor and materials. They were both lagging, probably on purpose. The old winners will be losers, and the old losers will be winners. gradually or suddenly after an economic earthquake.

Sokoman Announces Non-brokered Private Placement with Eric Sprott as Lead Investor

Cartier Acquires Globex Royalty Properties from O3

Benchmark Advances Engineering Towards Permitting a Gold and Silver Mine

Magna Gold Drills 12.80 metres at 498.08 g/t Silver within 55.95 metres at 155.86 g/t Silver starting 3 metres from Surface

Copaur Minerals and New Placer Dome Gold Corp. Sign Definitive Agreement for Business Combination

GoGold Announces Closing of C$46 Million Bought Deal Financing

Nighthawk Gold Reports Substantial Expansion of 121% in the Indicated Category and 1,400% in the Inferred Category in Pit-Constrained Mineral Resource Ounces; Re-Envisioning the District as a Potential Large-Scale Open-Pit Project

Kinross announces US$1.0 billion term loan

Damara Gold Continues to Intersect High Grade Gold in First Six 2021 Drill Holes at Placer Mountain, Including 1.40 Metres of 34.12 g/t Au and 87.74 g/t Ag

Exploration Update Taquetren Project, Argentina

https://ceo.ca/@thenewswire/exploration-update-taquetren-project-argentina

Stellar Africagold Hits 16 Meters of 2.9 g/t Gold in First Trench at Namarana Gold Project, Mali

https://ceo.ca/@thenewswire/stellar-africagold-hits-16-meters-of-29-gt-gold-in

Ascot Resources Announces Closing of C$64 Million Bought Deal Financing

https://ceo.ca/@nasdaq/ascot-resources-announces-closing-of-c64-million-bought

ORION MINE FINANCE ANNOUNCES RECEIPT OF ADDITIONAL SHARES OF SABINA GOLD & SILVER CORP.

https://ceo.ca/@newswire/orion-mine-finance-announces-receipt-of-additional

KORE MINING DISCOVERS THREE NEW DRILL TARGETS AT THE IMPERIAL GOLD PROJECT

https://ceo.ca/@newswire/kore-mining-discovers-three-new-drill-targets-at-the

Well gas up your car before tomorrow and grab some groceries and stocks

Bidens going to Ban Russian Gas.

https://www.washingtonpost.com/politics/2022/03/08/biden-bans-russian-oil-imports/

Mr Copper

Come to think of it California’s getting double taxed since they tax the tax.

Why is it the Government can get away with dictating to business how much oil they can produce.

Why don’t we have a non partisan group go after geoengineering and what they’re doing to the weather and environment.

Until then hedge your cost in commodities.

I think just got a message from Washington Post Bidens going to ban Russia oil. Can’t be sure, it pops up and disappears and can’t find it so I can delete them. If so who are they going to get it from?

Mr Copper

That’s crazy, might as well get a wood stove and those pellets. I watched a video on how some guy made fire logs out of junk mail. He put them in a bucket and soaked them till mushy then drained it and compressed it in another bucket with holes in the bottom to get the water out then shaped them into logs and let them dry.Just a idea before it goes to 8 dollars next lol

Food, gasoline, and heating oil? Should be income tax deductions

They keep saying higher gasoline is like a tax, and the crazy prices are the government’s fault, so should be deductible. I had to write a check for $1,404 for 300 gallons of heating oil Saturday. Fourth 300 gallon delivery this winter. Pain at the thermostat they don’t mention.

EU To Reveal Plan For “Potentially Massive” Joint Bond Sales To Fund Energy And Defense

This is a hugely inflationary move, as up until Covid the ECB could not sell Bonds direct…now tks to Covid and now the Ukraine situation, the ECB can start selling paper with Germany’s backing….and all the other dead beats tagging along……This was what the Old Bundesbank always feared from the Euro….the Italians/Greeks/Spanish getting the keys to the German safe……

Serious strength

Scum has been trying to waterfall us for the last 20 minutes and silver lost 2/3rd of its gains. Now, coming right back up.

I want to see some $50 up days!

Morning Buygold

Tks for pointing out GPL……I got some more ystdy……I would guess that it has some v large shorts, judging by the way it was crushed for days/weeks on end …they may cause a classic short covering rally…I see a big gap to fill 0.4370

Buygold 7:35

It would of been more impressive if I was in it when it gapped.lol That’s the only non pink sheet nickel stock in US but other mining stocks mine for nickel too.

Most all the stocks I checked anyways be PMs or metals are in oversold mean over bought areas. Some just bypassed a break like FCX and went straight up until some yesterday anyways. Maybe most so leaves me wondering what going to happen today or this week.

Yea probably best they don’t mention it.

My little GPL is popping this am

premarket @ $.327 up .057 on heavy volume. Volume yesterday was strong. premarket generally doesn’t have much volume at all in GPL

SM futures fading,…

Morning Goldie

Not sure why I can’t find stocks like JJN that make those sort of moves – impressive.

Didn’t expect gold and especially silver would recover from the overnight lows but apparently, they have, and with some gusto as gold got to $2025, silver smashing through $26.

The shares look a little tired to me so we’ll see if we can get them moving. This has been the quietest move to $2K, financial TV has mentioned virtually nothing, which is probably a good thing.

The USD is taking a breather finally. They’ll try to squeeze some shorts in the SM but I don’t think they’ll do it.

Just saw that rates are screaming higher – 10 yr. up 9 bps and pm’s are still higher. Right now it appears gold is teflon and is correlated to nothing.

Ipso 22:34

That reminded me I got a heads up to grab a nickel stock on Sunday then forgot about it. There are different ways to buy it which I might get in one long cuz they have other things going on too but look at this. Sheesh I don’t think I would have chased it.