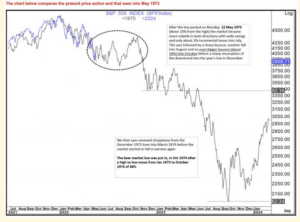

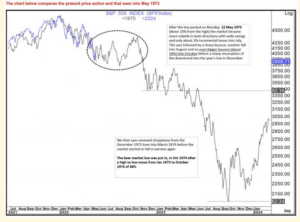

But It Fits For 1973

1973 had the Arab-Israeli war, the Oil shock and the Fed struggling with rising inflation.

S&P 500 (BLUE LINE) Mirroring 1973-1974

(BLACK LINE) Stock Market Collapse

All 16 runners who collapsed at the Brooklyn Half Marathon on Saturday said they were 'fully vaccinated.'https://t.co/6ppyeZvDrd

— Kyle Becker (@kylenabecker) May 23, 2022

,everyone wants to tear it apart and grab its resources ..all of Europe ,NATO,China covet Russias resources ..They may have poisoned Putin ..he might make it ,or not….Its going to be a feeding frenzy if he dies….

and when THEY think THEY got 90 % of whats available ..they gonna reverse coarse and take it down with help from the Media using their facilities to control public opinion and create the fear thats going to scare the hell out of the public and create panic selling at the end …in meantime they take down selected areas because that keeps the rest in the market intact until they are ready to take them down too ..

Buy Gold and HOLD ON its going to be a BUMPY ride but its going to last a long time because theres a lot of money to be had and their greedy hands cant hold it all at once .TWO-Three years down …if they control the decent ..!

Stumbled across this montage from the doomed Biden ‘88 campaign and I’m crying at the McLaughlin Group reactions at the end. pic.twitter.com/A9etqn8J4H

— Jimmy (@JimmyPrinceton) May 23, 2022

I can’t disagree with any of that.

The US is burdened by a traitorous elite that are only interested in gaining more power and feathering their own nest and the public be damned. and that is the least of it!

Good posts. I had no idea the Ruble is up 7% today, with the USD down 1%…hmm

So, demand for Rubles is up because Russia will only take rubles for oil and they’re sticking to their guns. Also sending a message to the rest of the world by cutting off Finland from Nat Gas.

There’s just this feeling to me that the way things will happen is we’ll wake up one day and gold will be up $200 and go massively volatile from there. It will be hard to hold our positions.

I’ll be the first one to admit that honest news is hard to come by – just like honest politics, precious metals markets (actually most markets), and covid treatments.

Actually, if Russia or the US were weak, China would take advantage. To me, Russia appears to be getting stronger, and the US weaker.

Russia is defending its borders, unlike the US.

Cheers!

Russia winning, not winning … I dunno.

I thought the idea of the appearance that they are not winning could tempt the Chinese re: Siberia was an interesting idea.

Cheers

“Russia’s spectacular failure in Ukraine has…”

Really?? Russia is winning. Check out The Duran

Look at the Ruble, much higher now than before the conflict – up over 7% today!

Saudi Arabia has signalled it will stand by Russia as a member of the Opec+ group of oil producers despite tightening western sanctions on Moscow and a potential EU ban on Russian oil imports.

Prince Abdulaziz bin Salman, the energy minister, told the Financial Times that Riyadh was hoping “to work out an agreement with Opec+ . . . which includes Russia”, insisting the “world should appreciate the value” of the alliance of producers.

Saudi Arabia signals support for Russia’s role in Opec+ as sanctions pressure mounts

But It Fits For 1973

1973 had the Arab-Israeli war, the Oil shock and the Fed struggling with rising inflation.

S&P 500 (BLUE LINE) Mirroring 1973-1974

(BLACK LINE) Stock Market Collapse

Could Siberia be a Greater Prize than the South China Sea for China?

Washington DC 16 May 2022

Russia’s spectacular failure in Ukraine has transformed China’s strategic options, for the better. Whereas Xi appeared ready to tandem-invade Taiwan just as soon as the olympics and party congress were out of the way, opening a second front in a new global war that Washington would have struggled to resist, Xi now has some important lessons from which to draw in reassessing his next moves. Why grasp at a porcupine when a big fat much despised sloth has fallen asleep on your doorstep? Unlike Taiwan, Siberia is not protected by a moat, is no longer protected by a major military force, is not likely to gain much international sympathy if attacked (smart balancers might even encourage/support such a move, or at a minimum look away), is vastly superior to Taiwan in terms of resources, is population scarce, already infiltrated by significant numbers of loyal Han Chinese, and the PRC arguably has as much claim to sovereignty over Siberia as it does over the South China Sea. Compared to Taiwan, Siberia is fecund, plump, low hanging strategic fruit.

more https://thirdoffset.substack.com/p/could-siberia-be-a-greater-prize?s=r

Almost seems as if we need the SM to start cratering again.

Ipso – I hope not health issues too.

the Monkey pox is gain of Function origin created in BIO LABS in China & Ukraine ..Putin tried to blow them up in Ukraine ‘

All the thanks he gets is NATO and the US gang up on him .They probably poisoned him….

same shit,different day !

Gave: The End Of The Unipolar Era

snip

Dominance of military technology is also a key factor underpinning the strength and resilience of a reserve currency. Today, one of the main reasons why Taiwan, South Korea, Japan, Saudi Arabia, the United Arab Emirates and others keep so much of their reserves in US dollars is that the US is widely regarded as being a generation (if not more) ahead of the competition in the design and production of smart bombs, anti-missile systems, fighter jets and naval frigates. In short, the superiority of US weaponry has been one of the principal factors underpinning the US dollar’s status as the world’s reserve currency. However, recent events raise important questions about whether the US can retain this superiority.

In September 2019, drones allegedly deployed by Yemeni Houthi forces took out the Saudi Aramco oil processing facilities at Abqaiq.

Between late September and early November 2020, Armenia and Azerbaijan fought a war over the Nagorno-Karabakh region. The conflict ended in near-total victory for the Azeris. This result stunned the military world. Observers had assumed that Armenia, with a bigger army, larger air force, more up-to-date anti-aircraft and anti-missile systems, and a history of Russian support, would easily triumph. But all Armenia’s expensively-acquired military “advantages” were quickly taken out in the early days of the fighting by Azerbaijan using Turkish-made drones costing no more than US$1mn each.

On successive occasions between March 2021 and March 2022, Houthi drones attacked Saudi Arabian oil facilities, notably the giant terminal at Ras Tanura on the Persian Gulf.

In December 2021, Turkish-made drones allowed the Ethiopian government to tip the balance in a civil war that until then had been going badly for government forces.

In January 2022, Houthi drones hit oil facilities in the UAE.

Now, imagine being Saudi Arabia or the UAE. Over the years you have spent tens, if not hundreds, of billions of US dollars purchasing anti-missile and anti-aircraft systems from the US. Now, you see relatively cheap drones penetrating these defense systems like a hot knife through butter. This has to be frustrating. What is the point of spending up to US$340mn on an F-35c (and US$2mn on pilot training), or US$200mn on an anti-aircraft system, if these can be taken out by drones at a fraction of the cost?

https://www.zerohedge.com/geopolitical/gave-end-unipolar-era

Meet The Globalists: Here Is The Full Roster Of Davos 2022 Attendees

https://www.zerohedge.com/geopolitical/meet-globalists-here-full-roster-davos-2022-attendees

“Where is Captain Hookie anyway? What about R640?”

Your guess is as good as mine. Market conditions might have something to do with it, hopefully not due to health issues.

A lot of proving to do for our pm’s though.

USD is back down but they’ve cut the gains in silver by 2/3rds.

Where is Captain Hookie anyway? What about R640?

“I think we’re at a turning point.”

Gosh I hope so! This has been a brutal beat down!

PS One of the Ole Lady’s son’s has recently moved to Texas from Wa State. Lots of things are cheap there but the property taxes are horrendous!

19K is just ridiculous, even more than there are mining companies.

PM’s looked really good when I woke up but now we’re fading into the sunrise.

I think we’re at a turning point, and this may be the start of the rally for pm’s that starts after the initial 6 months of correction of the SM

I think that’s what Captain Hook says has happened in 2001-02′ and 2008-09′. We’ll see how things shakeout this time with Bitcoin joining the fray.

Some guy was just on bubblevision saying that there are 19,000 different crypto currencies. He said that some would survive but most were garbage.

Don’t forget to invest in South Sea Bubble Coin! ![]()

OCEANAGOLD RELEASES SUSTAINABILITY REPORT

https://ceo.ca/@newswire/oceanagold-releases-sustainability-report

Osisko Development to Commence Trading on the New York Stock Exchange

https://ceo.ca/@nasdaq/osisko-development-to-commence-trading-on-the-new-york

Condor Gold Plc (“Condor”, “Condor Gold” or the “Company”) 34.1 Metres True Width at 2.56 g/t Gold From Near Surface Within La India Open Pit.

https://ceo.ca/@accesswire/condor-gold-plc-condor-condor-gold-or-the-company-a7f29

Robex: Kiniero Gold District Sabali South Discovery

https://ceo.ca/@nasdaq/robex-kiniero-gold-district-sabali-south-discovery

making sure this little rally is kept in check. Slowly chipping away at pm’s and shares.

USD has cut its losses in half already. It’s all about silver IMHO

…they’re essentially “worth nothing” as they lack underlying assets “as an anchor to safety”…