With respect to you, and everyone else on this site, that are more than likely to be more astute, in the technical analysis of financial matters than my self, I am still in a quandary. The red line average is reflective of the average closing price over the last 50 days, which I believe will lag the closing prices by that length of time. Are you suggesting that the scum are buying, when the prices fall below that lagging average line, or have you offset that average to 50 days in advance, ( in which case, I can’t differ, from the displayed chart ) Thank You so much in advance!

Opening up

Egypt awards eight new exploration licences to foreign miners

Egypt awards eight new exploration licences to foreign miners

Not surprising but never does much for the price

Demand For American Gold Eagles Explodes

The mint sold 147,000 ounces of American Gold Eagles in varying denominations totaling 200,500 coins. That was a 67% increase from March.

So far this year, the US Mint has sold 661,500 ounces of American Eagles. For the year, gold bullion demand is up a staggering 617%. When you factor out COVID-19-related sales disruptions, bullion sales are up 400% over the 5-year average between 2015 and 2019.

A market strategist told Kitco News that the surge in demand for physical metal reflects growing investor anxiety bubbling under the surface.

https://www.zerohedge.com/markets/demand-american-gold-eagles-explodes

Almost 10 am in NYC

Time for the Cudgel Crew to show up and beat us senseless …again !

Now we’re talkin’

could use a good boost from the shares, lookin’ good out of the gates.

$1865 breached

time for the shares to step it up.

New Poll New Poll

Vote! Vote!

Wesdome Expands Folded Kiena Deep A Zones Down Plunge and Confirms Mineralization in a Second Limb at Depth

https://finance.yahoo.com/news/wesdome-expands-folded-kiena-deep-203000911.html

Newmont Completes Acquisition of Properties to Support Land Use Planning in Tahltan Territory

https://finance.yahoo.com/news/newmont-completes-acquisition-properties-support-110000134.html

VR intersects 205 ft of silver and gold mineralization in its first hole at Amsel; plans are now underway for the second leg of drilling this summer

https://finance.yahoo.com/news/vr-intersects-205-ft-silver-130000854.html

Underground Drilling Progressing on Globex’s Labyrinth Gold Mine Royalty Property

https://finance.yahoo.com/news/underground-drilling-progressing-globex-labyrinth-144200127.html

Magna Gold Files Independent Technical Report for the Margarita Silver Project

https://finance.yahoo.com/news/magna-gold-files-independent-technical-221100500.html

Skeena Completes Acquisition of QuestEx and Concurrent Sale of Assets to Newmont

https://finance.yahoo.com/news/skeena-completes-acquisition-questex-concurrent-231500852.html

Endurance Provides Drill Program Update at the Reliance Gold Property

https://finance.yahoo.com/news/endurance-provides-drill-program-reliance-110900149.html

VIZSLA SILVER EXTENDS HIGH GRADE MINERALIZATION AT SOUTHERN END OF NAPOLEON, INTERSECTING 2,098 G/T AGEQ OVER 4.30 METRES

https://finance.yahoo.com/news/vizsla-silver-extends-high-grade-120000975.html

Alliance, Drilling and Work Plan Updates On Packsack, CUPP, Fox and Wolf Mineralized Gold Zones – Bissett-Rice Lake Belt – Manitoba

https://ceo.ca/@accesswire/alliance-drilling-and-work-plan-updates-on-packsack

Queensland Gold Hills Completes Inaugural Drill Program at the Big Hill Gold Property in Queensland, Australia

https://ceo.ca/@newsfile/queensland-gold-hills-completes-inaugural-drill-program

Visionary Gold Corp Stakes Claims at New Anderson Ridge Property and Samples up to 15.95 g/t Gold, 6.18% Copper and 27.7 g/t Silver

https://ceo.ca/@newsfile/visionary-gold-corp-stakes-claims-at-new-anderson-ridge

NevGold Makes Cadillac Valley South Discovery With 650 Meter Step-Out And Intercepts More Oxide Gold

https://ceo.ca/@nasdaq/nevgold-makes-cadillac-valley-south-discovery-with

White Gold Corp. Announces Webinar to Provide Overview of its Fully Funded $6 Million 2022 Exploration Program & Corporate Update

https://ceo.ca/@nasdaq/white-gold-corp-announces-webinar-to-provide-overview

OUTCROP SILVER INTERCEPTS 3 METRES OF 774 GRAMS SILVER EQUIVALENT IN NEW SHOOT AND OBSERVES NATIVE SILVER IN CORE FROM TWO NEW TARGETS WITH PENDING ASSAYS

https://ceo.ca/@newswire/outcrop-silver-intercepts-3-metres-of-774-grams-silver

Maritime Resources Provides Update on Hammerdown Gold Project

https://ceo.ca/@newsfile/maritime-resources-provides-update-on-hammerdown-gold

Whoops

The SM just fell out of bed. Looks like an average gold takedown.

We are holding steady…good stuff.

mruk/buygold

That is a weekly chart of the Dollar index, with a 15 week simple Moving Average, overlay…..u can see whenever the mkt breaks below the Av, someone…aka the scum, come in and support it and push it back above the AV.

A 15 week Av is v close to a 50 day Av….

The great JAMES KUNSTLER=The pharma companies, the doctors, the hospital administrators, and the politicians must be frantic with terror of being found out.

The strange parallel question has been raised: might laissez-fair abortion be a cover for the evident new problem that Covid-19 vaccines have made a shocking number of birthing peopleincapable of reproducing? There’s a buzz about it, anyway. It’s a fact that Pfizer excluded pregnant and breastfeeding women from all phases of its mRNA trials. Among the various harms now ascribed to the mRNA shots are infertility, miscarriage, and newborn abnormalities. But, of course, that sort of rumor — here coming from cases among vaccinated military personnel and not so easily hushed up — is just what the many lurking censors want to slap down in any forum where ideas could be exchanged. It’s misinformation!

And so, the derangement volume knob over Twitter changing ownership stays up at eleven. Imagine what will happen if the supposedly 70-odd percent of Americans who got vaxxed learn in a re-liberated Twitter Zone that the Covid-19 vaccines are not “safe and effective.” According to Zero Hedge, twenty-six globalist NGOs with ties to George Soros signed a letter saying, “Elon Musk’s takeover of Twitter will further toxify our information ecosystem and be a direct threat to public safety, especially among those already most vulnerable and marginalized.”

They are, as usual, projecting — since what is a greater threat to public safety than inducing tens of millions of frightened citizens to accept multiple shots of a poorly-tested pharmaceutical cocktail that can kill you six ways to Sunday? The folks in-charge (and others who would like to be the boss-of-you) don’t want you to know any of this. =

Altogether, the scene looks like a multi-dimensional nightmare. Broken economy… sinking Western Civ… police state tyranny… vaccine death and injury… starvation…. So, there it is. Oh, look, those markets… they’re puking again!

Here comes the onslaught

No way does gold hold $1850. B.S.

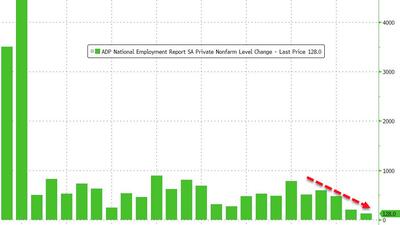

ADP Report came out – PM’s holding steady on the upside

Small businesses saw 91,000 job losses…

Wow somebody just woke Oil up

I guess Opec didn’t follow that BS story from the WSJ……the WSJ used to be a decent paper…..not anymore.

Morning mruk

Yeah, I wasn’t sure what that chart was saying either.

Palladium, Platinum catching a small bid

Platinum looks like maybe it’s bottomed? I’d think palladium is doing the same.

Shares not exactly surging in the premarket, so no clue whether we can hold these meager gains.

Maddog @ 12:07

Maddog,

Can you kindly explain your logic, in the use of that chart. I guess, that I don’t understand, Thanks!

Jamie Dimon

says “there’s a hurricane coming, we just don’t know how hard it’s going hit.”

Oil could go to $150-175 a barrel.

Normally I’d think he is lying, but he may have a point. I think most of us here believe that the economy is in trouble and may get a lot worse.

The only question for me is whether pm’s react positively. So, years ago there was speculation that JPM had stockpiled 700 million oz. of silver. If so, I wonder what Dimon’s plan is for that?

Quietly probing $1860 – but firmly rejected

Silver is solid.

Just noticed Bitcoin, didn’t realize it got smashed all the way back to 29K. More evidence it is linked to the Nascrack.

Energy is down across the board with the exception of Nat Gas.

Early look

trying to hold above $1850 and $22. USD taking a breather so far, so might be a tailwind?

ADP numbers come out this am – that might be interesting.

10 yr. up a bps, oil taking a 2.5% hit – good put that money into gold instead.