Posted by Mr.Copper

@ 22:46 on June 19, 2022

So the gov’t knows everything. And probably figures a part of the public is well off. If rates keep climbing, more money will go there. A friend of mine needed a few hundred thousand dollars, and took a mortgage. He didn’t want to sell some stocks because he did NOT want to pay the taxes on the profits.

See how the system works? It wants you to put money in, but not take any out. If your stocks keep going up it makes you add more of your excess income. Nobody has their money. Its all been handed over for the greater good.

The Fed probably sees all the excess money supply in stocks and real estate, and if they pull it out to spend on things it causes inflation. So they raise the rates and take money out of stocks or real estate and put it in the bank instead.

Just like the 1970s. They kept raising rates to make people stop spending and stop driving prices higher, and let Daddy hold the money. And you leave it there for the interest income. Remember those days? If grand pa had a couple hundred K he could live off the interest payments. Maybe that will come back. Reversal of present days.

Posted by ipso facto

@ 21:55 on June 19, 2022

Hit me too!

Posted by ipso facto

@ 21:53 on June 19, 2022

That cop was fast with his pistol, fortunately. I sure wouldn’t want to be a cop, you could never relax.

Posted by amals

@ 20:15 on June 19, 2022

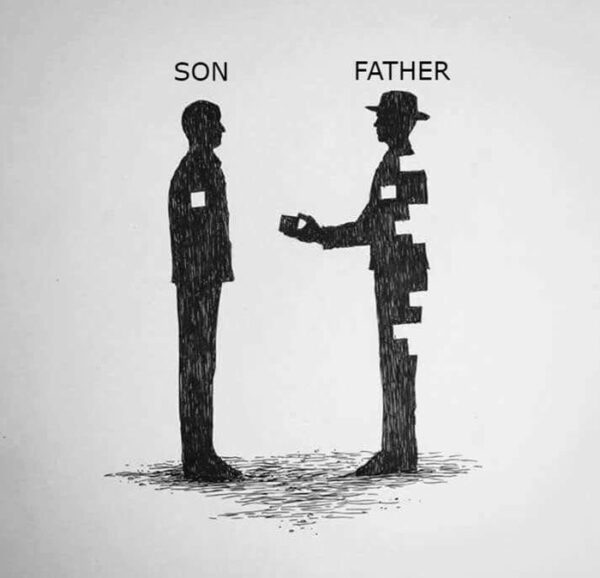

What a great image, and poignant way to express the concept of a Father’s selflessness. Very cool.

Posted by goldielocks

@ 17:39 on June 19, 2022

The world bank is even worse. Silver 4 0z by 2030. How that gonna fit in with inflation, industrial and medical needs, dollar devaluation despite interest rate hikes, and increasing spending and debt.

It’s not but I’m sure they love a one world digital currency.

Silver prices to fall by $4/toz by 2030, World Bank says

Posted by goldielocks

@ 17:32 on June 19, 2022

Another reason for gun ownership. He picked on the wrong man, not only fast but knew to keep backing up because even if shot lethally they can keep coming at you for a few feet.

Posted by goldielocks

@ 17:21 on June 19, 2022

Posted by ipso facto

@ 17:09 on June 19, 2022

Posted by ipso facto

@ 16:58 on June 19, 2022

Posted by ipso facto

@ 16:57 on June 19, 2022

Posted by goldielocks

@ 16:44 on June 19, 2022

They actually believe that Putin is the cause of high gas prices. Are the foreign nationals or just gullible. We don’t get our gas from Putin. We have our own. They neglected to look at weekly rising prices to daily before the war in Ukraine.

Plus this war is not our war and something between both countries that’s been going on for a long time and Biden is just injecting himself it it.

What is he going to do about the Dept?

Posted by old-timer

@ 15:54 on June 19, 2022

Posted by MetalsGuy

@ 15:24 on June 19, 2022

What we are seeing is a false apparent strength of the USD. The excessive currency creation, low-interest rates, and bailouts guaranteed CPI inflation and it was already becoming apparent before the Ukrainian-Russian conflict. The back-firing of the sanctions against Russia only served to increase the pressure on the supply of raw materials and therefore create further pressure on the CPI. The theft of Russian funds by Western banks has also served to make other countries more aware of the vulnerability of their Western-held funds and encourages them to move further away from the USD system. The Bric+ group is strengthening their ties and soon will be a viable alternative to the Western financial system. The USD is definitely close to losing its sole reserve currency status.

I don’t know when gold will finally break up, but some of the factors above will definitely accelerate the process. You can bet that Russia is buying more gold as one way of keeping its Ruble from getting too strong (selling Rubles for gold). In the future, their gold will act as a support for the Ruble.

Posted by Buygold

@ 14:14 on June 19, 2022

No question the USD is falling against real goods, even falling vs. gold but seems slow.

One thing was true Friday, the USD was strong against the other fiats and gold.

I’d like to know when gold is going to take command and where all the money is going from the sale of stocks and bonds and Bitcoin?

BTW, Bitcoin is attempting a comeback, and trying to push back above $20K

Posted by Richard640

@ 12:41 on June 19, 2022

immediately reversed on Friday–are rising artless responsible?

Posted by MetalsGuy

@ 11:29 on June 19, 2022

There is only a USD relative strength against a basket of other fiat currencies falling towards zero. Many incorrectly see the USD as a safe haven, so they invest. It might be safer but not safe.

Just look at the cost of goods in USD; it is plain to see that it is losing value.

Yes, the Ruble’s purchasing power is holding better than any other major currency, as they are producing real goods.

Posted by Buygold

@ 11:00 on June 19, 2022

The Ruble is up 22.5% on the year vs. the USD. How is that even possible? OTOH, if they have actually backed their currency with gold or other commodities, it makes perfect sense and should be falling faster against the RUB.

Something just isn’t right with the USD strength. JMHO

Posted by Richard640

@ 9:50 on June 19, 2022

And it knows Davos has zero leverage over Russia’s actions from here on out.

“The game of nominal value of money is over, as this system does not allow to control the supply of resources. …Our product, our rules. We don’t play by the rules we didn’t create.”

Miller’s statement should be thought of as a statement of principle across all theatres of operation for Russia. This doesn’t just apply to natural gas or oil. This is everything, all of Russia’s dealings with the West from here on out will be on its terms not the West’s.

This is clearly the biggest geopolitical middle finger in the post WWII period.

Miller is clearly laying out the rules for a new, commodity-centric monetary system, one based on what Credit Suisse’s Zoltan Poszar called ‘outside money’ — commodities, gold, even bitcoin — rather than the West’s egregious use of ‘inside money’ — debt-based fiat and credit — to perpetuate old colonialist behavior well

after Russia soft-pegged the ruble to gold.

https://www.zerohedge.com/geopolitical/luongo-russias-new-rules

Posted by Richard640

@ 9:39 on June 19, 2022

Posted by Buygold

@ 9:33 on June 19, 2022

Yes, let’s hope the COT’s are going to come through and get us some higher metals prices.

Looks like sellers are content holding dollars for now.

(@JackPosobiec)

(@JackPosobiec)