Ireland targets 25% cut in agriculture emissions but farmers voice anger https://t.co/bBzFUjftQF

— Ewald Engelen (@ewaldeng) July 30, 2022

Sounds like a 25% food production reduction to me

Pelosi’s plane is on the way

PELOSI’S plane has left the US mainland after a short stop at the Travis Base, & just arrived at a cruise alt of 32,000 ft.

It’s a Boeing C-40C, which is basically just the military term for a type of 737.

With a range of only 5,000+km, it will need to refuel en route to Asia. pic.twitter.com/3dv697LZx3

— Andy Boreham 安柏然 (@AndyBxxx) July 30, 2022

Ororeef

Opening the link both Mayas witch pic lol and your beach pic showed up too. I wonder if my phones censoring what I see lol

Btw have you noticed that, I think I mentioned this here before, that every even year there are more shark attacks than odd years. I wanted to go ocean kayaking this year but decided to wait and see if it happens again. Especially for northern Cal and sure enough here they come.

Ororeef

It’s blank on mine. Id take a snap pick but I think I maxed out my pictures. Lots of stock charts with them.

If I open your heading as I was going to try a save image pic it appears when you open it.

goldielocks @ 6:36 on July 30, 2022

Really ? they show on my screen ? I went back to check and they still there !

also checked on my laptop with Linux op system its there ok..

Morning Maddog – if you’re around

or anyone else who’d like to chime in…

What is your take on the 10 yr. treasuries, now below 2.7%? They’ve fallen the last couple of days. Bonds have been trading like the Fed is done. Are they right?

Maybe a clue about the direction about the USD as well?

Ororeef

You posted a couple of pictures, one of a chart one of a hometown? Neither came through. It’s blank.

Morning Ipso

Agree, COT is a big deal.

We got a nice taste of the kind of rallies we might be in for on Thursday. Hoping silver turned the corner this week,

Hard to understand why the funds keep shorting down here, seems a bit overdone to me. Really hoping for a blowout silver day on Monday that drags gold with it.

ipso facto @ 9:26

Yeah, we get a lot of rain here at the tip of the windward ‘spear’ where tradewinds encounter mountain upslopes… and shed moisture. But it’s a micro-climate. On the other side of the mountain we have lava rock deserts.

Yah… Shoot that down

Apologies for that mental image

Buygold

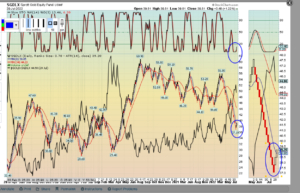

“The funds net short”

That’s Big Big Big! ![]()

COT Report – epic action in silver. First time I’ve ever seen the funds net short!

CFTC Commitments of Traders Report – CMX (Futures Only)

GDX, GDXJ -First positive week since mid-May from what I can see, although it doesn’t inspire a lot of confidence as it was pretty week. Anyone in this game will take it, me too.

Maddog

LOL That’s darn fine shootin!

ipso facto

RE Pelosi

U gotta admire those new Chinky missiles, if they can hit a broomstick, at 30,000 ft !!!!!!

Berlin may not be first EU city to have lights go out.

No link sri

Paris Faces an Even Colder, Darker Winter Than Berlin

July 29, 2022 at 9:42 a.m. EDT

In the European energy crisis, all of the attention is focused on Germany and gas from Russia. But France and its fleet of struggling nuclear reactors are at least as important. Indeed, the first European city to suffer a blackout as temperatures drop toward the end of the year may well be Paris rather than Berlin.

As winter approaches, the outlook in France is increasingly dire. Electricite de France SA, the state-owned utility, is running only 26 of its 57 reactors, with more than half of its chain undergoing emergency maintenance after the discovery of cracked pipes. With atomic reactors generating the lowest share of the country’s power in 30 years, France faces an electricity ‘Waterloo.’

The slump in nuclear availability is forcing France to rely more than ever on gas-fired plants, intermittent wind and hydro as well as imports. That’s pushing up the cost of electricity in the wholesale market for the whole of Europe, with French forward prices surging to almost 1,000% more than their decade-long average through 2020.

In the middle of the summer, when French electricity demand hovers around 45 gigawatts per hour, that’s not an insurmountable problem. But on a cold winter evening, when French households can push consumption above 80 or 90 gigawatts, it could be catastrophically expensive. Although the French economy is smaller than Germany’s, Gallic power demand surges well above that of its neighbour during the winter as households there rely more on electricity for heating and hot water.

While EDF has promised that at least some of its reactors will be back online in time for the colder months, the company has a nasty habit of over-promising and under-delivering. The severity of the winter could be key: Each degree Celsius the temperature drops below normal, French power demand surges by about 2.5 gigawatts an hour — equivalent to the output of two nuclear power stations.

During a late cold snap last April, the French grid was forced to issue a rare orange alert — the second highest — asking households and companies to “moderate their consumption.” Those alerts will become a staple this coming winter, and very likely will escalate to “red alerts” that indicate a risk of blackouts unless families and businesses reduce demand.

Electricity traders are taking the risk seriously. In the wholesale market, the benchmark one-year French baseload power contract has jumped to a record high of 507 euros ($512) per megawatt hour, well above German prices of 350 to 370 euros for the parallel contract. French retail consumers are protected for now thanks to a price cap, but businesses are fully exposed.

Come winter, it will get much worse. For December, baseload French power is trading above 1,000 euros, almost double German prices, while peakload power — typically in the evenings when families gather for dinner and the heating is on — is changing hands at more than 2,000 euros. In practice, that means traders expect French power demand may be so high relative to supply that so-called hourly prices will bump against the 4,000-euro limit set by the exchange many times in December. The market, aware of what’s coming, is trying to kill consumption ahead of time, in an effort to avert blackouts. It’s a costly way of attempting to force electricity-intensive companies, such as smelters, to plan to shut down in December.

The French problem is spilling over into the rest of Europe, including the UK. EDF, long a source of national pride as well as low-cost electricity exports, is having to buy power to meet daily requirements. Earlier this month, the French grid made an emergency request to the British network for extra power — and that was in summer, when demand is low.

In the past, EDF only imported electricity on a net basis for a few days a year, if at all. For example, between 2014 and 2016, France didn’t import power on a single day. But as the nuclear troubles mounted, it’s relied increasingly on imports. Last year, it bought electricity from overseas for 78 days. So far this year, it has been forced to do so on a record 102 days.

France’s purchases put further pressure on a European electricity and gas market that’s already under stress. If French President Emmanuel Macron wants to help ease the European energy crisis, he needs to focus at home. Fixing EDF should be his top priority — well above his phone conversations with Russian President Vladimir Putin.

Paris has taken a first step, announcing the nationalisation of the company at a cost of 10 billion euros, although not earlier than September. Puzzlingly, Macron has yet to bring in a new executive team. The company’s chief executive is set to depart, but perhaps not until March 2023. The rest of the senior team, including the executive in charge of nuclear power who has overseen the disastrous performance of the last couple of years, appear to be safe in their jobs for now. Macron also hasn’t curbed the influence of the trade unions within EDF — another perennial issue that’s stymied reform at the company.

Time is running out. Paris is delightful in the autumn and the winter; it’ll be much less attractive if the “City of Light” is forced to go dark.

D’oh!

China says it WILL shoot Pelosi’s plane down IF she travels to Taiwan under US fighter escort

Whose The New Kid On The Block? NEWP? New Pacific Metals On The Silver Miner ListList

It up 20% on a 6 mo chart with GLD flat on zero 6 mo. GATO looks the same, 22% on a 6 mo with GLD overlay. AU AG and the Miners are going Green LOL.