I’ve got a bunch of marginal stuff too that’s only worth a fraction of what I bought it for. Sometimes they do come back. At least some of them will be good for tax loss selling at the end of 23. I’m hoping I’ll need them! ![]()

Alex Valdor

IPSO re: the mover

YEP ! Rode it a long way down .

Kept adding because they were processing ore for others to stay afloat .

Could still be a winner , but in low value dollars .

Yoikes!

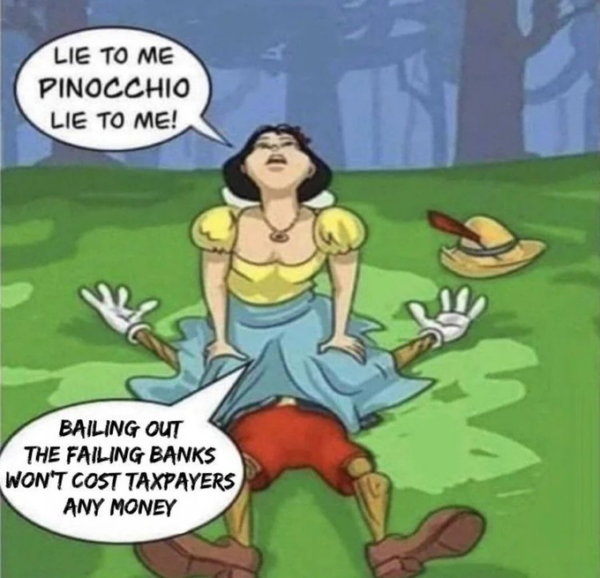

Of course, as during the previous financial crisis, government and financial executives will make reassuring statements, such as the one made by Treasury Secretary Yellen last Friday when she reassured the public that the American banking system is resilient and well capitalized.

But is it? The five banks labeled “too big to fail” have $188 trillion in derivatives. The brutal fact is that 5 US banks have risk exposure that is twice the size of the GDP of the entire world. It is incomprehensible that 5 US banks have sufficient capital to back derivative bets that are twice the size of world GDP.”

Alex Valdor @ 12:0

It’s only a 75% move. ![]()

Hope you’ve got a lot of it! ![]()

Kunstler

This Has Got to Stop

And it will stop because, as the old wag Herb Stein laid down in his law years ago: Things that can’t go on, stop. Which raises the question: which things? And the answer is the things Western Civ is doing in its attempted suicide: inciting war, recklessly running up debt, persecuting its own citizens and stealing their liberties, subjecting them to medical malfeasance, destroying their goods production and food-growing capabilities, and subjecting the public to incessant mind-fuckery in a campaign to falsify and disfigure reality.

Frickin’ AG

Temporarily suspends mining ops at Jerritt Canyon. I’m done with them for a while, too costly to sit on dead money in a raging bull market. A lesson I didn’t learn the last decade. Took an awful beating again.

NEM kept on ice but GDXJ looks great

They’ve been sitting on NEM all day after a decent start. We’re back to a little momo going into the last hour, which have been good to us lately.

Dolly Varden having a good day on heavy volume. No news I can see good for 11%

Silver shares acting well

Some of them have some serious catching up to do. Like AG…

Ipso

I hope you’re right and it is finally time. I’ve heard a couple analysts reco gold and miners on FOX Business but the subject of pm’s is largely being ignored. That’s hopefully a bullish sign.

Rates moving up throughout the day. They seem to matter more than the USD.

Here comes another push towards $2K

De Santis acting just like the swamp

On new harassment by these radical left scumbags wanting to derail Trump

DeSantis slams Manhattan DA in first remarks on potential Trump indictment

Aurum – I could see that scenario

We get up to 250-265 area on the HUI, and then pull back here to 240. Equivalent moves in GDX and GDXJ.

The juniors are doing much better today.

Buygold

Now is the time we’ve been talking about for years! The Fed can’t raise interest rates far enough to fight inflation without collapsing the economy. Now is the time.

Perhaps that’s why the PM shares are higher today with gold and silver price action lackluster. The Big Move higher is inexorable!

Ipso, deer79

Ipso – yes, Egon’s article was very good and he seems to be seeing what we’re seeing. He admits being 20 years early for the “big” one. Truth is, every guru was been early on gold for years.

deer79 – yes, Fed meeting Wednesday. I agree with your assessment in getting gold to a manageable level before they announce and speak. They’re having a helluva time keeping us bottled up.

Britain’s banking system is ‘safe and sound’ after $2bn Credit Suisse rescue deal, Bank of England insists

I shall sleep like a baby…..like’eff I will.

Scorpio

Big move!

PM’s

If the count I posted some days ago is correct and it is more iffy than usual, we should have another leg up in this move and then revisit this area. The move off the last low needs to have an impulsive look when completed and the move back down needs to have a corrective look.

aurum

another possibility is a revisit to the 29 GDX area but again that revisit needs to have a corrective look.

Buygold

I forgot: is Wednesday the day the Fed decides on interest rates?

For the scum, yes, it’s all about “levels”. Getting gold to a more manageable level ( in their eyes), so if they don’t raise, it will be a more manageable level

Deer79

I meant control them. I agree with you that this might be one of the last opportunities for people to protect them selves but we thought that for a long time so we’ll see. Nice to see the first our baloney is over let the games begin.

using my voice for that post, so it might not be right exactly.

FWIW

Many questions from worried people ..

IMHO:

No, this is NOT a repeat of the 2008 crisis

No, your money is not at risk, banks deposits safe (for now)

No, markets wont crash

Yes, QE is back. Money is pouring into the system again

Yes, the paper-to-hard-assets trend will go…

— Willem Middelkoop (@wmiddelkoop) March 20, 2023

Buygold

Control him?

Once again, I could very well be wrong, butI have to think that this may be one of the last opportunities to load the boat

Dollar getting hammered

Not helping us at all but the scum Hass to get metals prices down before Wednesday because after Wednesday they won’t be able to control him. JMH.