https://www.thegatewaypundit.com/2024/12/invasion-drones-breaking-truth-behind-mystery-drones-new/

Omg

Shooting at Christian School Madison Wisconsin. Multi injuries.

Buygold

Just look at it this way. A trillion has 12 zeros behind it. If your finding one percent you can look at it fractionally

1/100 and 2000000000000 /1 cross cross to cancel 1 2 trillion dividend by 100 is simply canceling out zeros. 2 trillion divided by 100. 20 billion cancel the couple zeros.

I get that but not the gold backs, I’m learning about gold backs. This 100 percent to purchase doesnt give you fair purchasing power but loss in dollar terms. . How do they calculate their worth when the pog changes. I don’t know if I have the energy for that right now. Doesn’t recessions always follow wars too?

Buygold @ 6:52

Yes, the math is insane … it’s so good I should have paid more attention to it. (like you said – lots of zeros) Lots of room for insane adoption growth. That’s the key concept.

But I was busy and had to go, on top of being excited about the utility and tax benefits of Goldbacks now that the premium is lower – to a point it can more easily be recovered via appreciation – but also remembering given the cost of producing the lower denomination notes, this premium will not likely go down much (if at all?) from here.

Again, this means if gold goes up 100% from here … so will the cost of Goldbacks at the source.

I don’t know what they will trade for in public use, but I will assume it would be more than spot prices. (but could be lower than the cost initially – so they can be used as currency right away, but it would undoubtedly be better to wait for appreciation.)

In a few years this consideration will probably be a moot point.

Having a few on hand is likely not a bad idea just on this basis alone.

And then there are the tax benefits.

Calculate this one … if you sell an asset … pay the tax on it … you will have some currency to pay for something.

Let’s say you reinvest the after-tax proceeds into something else and do this all over again … and again … and again … forever to pay the parasites their taxes. (let’s call this ‘compound taxation’ – the opposite of compounding returns)

Thing is, unlike bullion … which must be converted into currency on an after-tax basis … you don’t have that worry with Goldbacks … as they are ready to use as legal currency in increasing jurisdictions / purchases. (and can be retained for appreciation)

Because you are always in gold of course.

So how much tax does that save you?

Go ahead and calculate that.

I will leave that for somebody else as I must go again.

Cheers all

PS I know constitutional silver is obviously an alternative, and should be acted upon on that basis, but sometimes you might need gold. Gotta go

New play today

Sell pm’s, buy tech and accumulate dollars.

Oh wait!

Suckitude

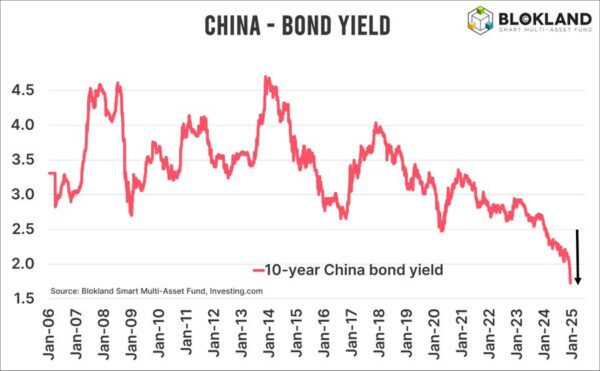

This chart on the #China 10-year bond #yield is crazy!

That yield has collapsed to just over 1.7%. In late 2020, the yield was double what it is now.

It shows that China’s economic woes are far from over, and the government will do what all aging economies do: Increase government spending, allow bigger #deficits and #debt levels, and push interest rates down toward zero.

There is no way China will be able to ‘organically’ reach its 5% GDP growth target.

Buygold You are correct! Izzat your gold stash?

200 million / 2 trillion

0.0001

2 trillion * (.01%)

200 000 000

Ipso so

$200M would be .01% of $2 Trillion?

Dats a lot of zero’s

Buygold …. straight from Duck Duck Go. Looks like 20 billion. Cheers

(1%) * 2 trillion

20 000 000 000

SNG and goldielocks re: disappearing posts

This may have something to do with the faulty download we had which knocked us offline a few days ago. I doubt it’s the work of an alphabet agency although stranger things have happened. It may be useful if you are writing a lengthy post to do it separately in “word” or some other program and then copy-paste it over to the Tent. Just a thought.

Cheers

ipso

Endurance Extends Reliance Mineralization Significantly at Depth and Discovers New Zone – New Lower Imperial Zone With 7.18 gpt Gold over 8.3 m Including 28.08 gpt gold over 1.7 m

https://ceo.ca/@newsfile/endurance-extends-reliance-mineralization-significantly

Tudor Gold Reviews 2024 Program, Which Shapes Future Strategy for Treaty Creek Project Located in the Golden Triangle of British Columbia

https://ceo.ca/@newsfile/tudor-gold-reviews-2024-program-which-shapes-future

Barrick Update on Mali Operations

https://ceo.ca/@GlobeNewswire/barrick-update-on-mali-operations

Skeena Gold & Silver Receives Approval for Bulk Technical Sample at Eskay Creek and Provides Update on Other Regulatory Activities

https://ceo.ca/@accesswire/skeena-gold-silver-receives-approval-for-bulk-technical

Meridian Drills Further High-Grade VMS Mineralization at Santa Helena – 58.9m @ 3.6g/t AuEq (2.8g/t Au, 0.7% Cu, 19.0g/t Ag & 1.7% Zn)

https://ceo.ca/@accesswire/meridian-drills-further-high-grade-vms-mineralization

Radisson Drills Deepest Hole at O’Brien Gold Project and First Below O’Brien’s Historic Workings, and Intersects High Grade Gold Mineralization Including 242 g/t Gold over 1 Metre

https://ceo.ca/@GlobeNewswire/radisson-drills-deepest-hole-at-obrien-gold-project

Gold Hunter Resources Validates and Extends Mineralized Trends at Great Northern, Setting the Stage for 2025 Drill Program

https://ceo.ca/@newsfile/gold-hunter-resources-validates-and-extends-mineralized

Fortuna extends Kingfisher deposit with drill intersect of 4.1 g/t Au over 15.3 meters at the Séguéla Mine, Côte d’Ivoire

https://ceo.ca/@GlobeNewswire/fortuna-extends-kingfisher-deposit-with-drill-intersect

First Nordic Commences Top-of-Bedrock Drilling Program on Nippas Target, Gold Line Belt, Sweden

https://ceo.ca/@newswire/first-nordic-commences-top-of-bedrock-drilling-program

Miata Metals Provides End-of-Year Operational Update on the Sela Creek Drill Program, Suriname

https://ceo.ca/@GlobeNewswire/miata-metals-provides-end-of-year-operational-update

Silver Crown Royalties Executes Definitive Agreement to Acquire a Third Producing Royalty

https://ceo.ca/@thenewswire/silver-crown-royalties-executes-definitive-agreement

Carlyle Acquires Miramis Mining Corp. and Nicola East Property Option, Completes Quesnel Gold Project Field Program, and Provides Corporate Update

https://ceo.ca/@newsfile/carlyle-acquires-miramis-mining-corp-and-nicola-east

Starcore Reports Q2 Results

https://ceo.ca/@newsfile/starcore-reports-q2-results-a0891

Asante Files Financial and Operating Results for the Quarter Ended October 31, 2024

https://ceo.ca/@GlobeNewswire/asante-files-financial-and-operating-results-for-the-e2d56

Cascada Announces Closing of $1.0 Million Private Placement

https://ceo.ca/@newsfile/cascada-announces-closing-of-10-million-private-placement

NexGold and Signal Gold Complete Business Combination

https://ceo.ca/@GlobeNewswire/nexgold-and-signal-gold-complete-business-combination

Falcon Gold Announces Termination of CentreLine Drilling Contract, Engagement of New Drilling Contractor for its Great Burnt Copper-Gold Project in Central Newfoundland

https://ceo.ca/@accesswire/falcon-gold-announces-termination-of-centreline-drilling

Muzhu Commences 5,000 Ton Bulk Sample at Wulonggou Gold Mine

https://ceo.ca/@thenewswire/muzhu-commences-5000-ton-bulk-sample-at-wulonggou

Novo Strengthens Portfolio With Two High-Grade Gold Projects in NSW, Australia

https://ceo.ca/@GlobeNewswire/novo-strengthens-portfolio-with-two-high-grade-gold

Further Adjournment of Meeting for Approval of Spin-Off and Reverse Takeover with Allied Critical Metals Corp.

https://ceo.ca/@thenewswire/further-adjournment-of-meeting-for-approval-of-spin-off

Osisko Development Provides Bulk Sample and Underground Development Progress Update at Cariboo Gold Project

https://ceo.ca/@GlobeNewswire/osisko-development-provides-bulk-sample-and-underground

VR Resources is Underway on Hole 4 at Empire with an 800m Step-out from Hole 2 on the Opposing Margin of the Westwood Intrusive Complex

https://ceo.ca/@GlobeNewswire/vr-resources-is-underway-on-hole-4-at-empire-with-an

Throwing us a bone

and that’s about it for now.

Dollar is flat, rates down 2.4 bips, oil down 1%, Bitcoin was up 5-6% over the weekend above $104K, now giving 1% back this am

Fed meeting this week, hard to see anything positive for us there, whether they cut or not. If they don’t cut, all hell will break out in pm’s after the meeting. If they do cut, we’ll just get hit less hard. Regardless, the SM will just keep steaming ahead.

Some eco data today – PMI’s @ 0945 am. In fact, quite a bit of eco data this week, including retail sales, GDP.

Truth is, I’m having a hard time seeing anything that will be bullish for the metals after the drubbing last Thurs. & Friday. Paper is king with TSLA almost having doubled since the election, Nasdaq up something like 33% this year, I think the S & P is looking at back-to-back years of 20% gains. Bitcoin a double.

We’ve had a decent year in the metals, but why doesn’t it feel that way?

aufever, igold

yes, of course you are right! I’ve never been much of a math wizard and am old enough to remember when a million was a big number.

igold – I tend to agree with you, the Goldback is a great idea, although I have no idea why anyone would pay a 100% premium, much less 600%. I’d think that eventually if use became widespread, premiums would probably come down in exchange for the metal. I don’t know.

Maya

Btw especially since your in a rainy area and prone to hurricanes.

I was talking my friend in Texas. She’s in the field of chemistry. She mention her brother called her once saying he’s dead, and she said he sounded dead. That’s was a mixture of empathy with humor. Change of weather and thought it’s being caused by the drop in barometric pressure in weather change. I bet she’s right, there’s got to be a study on it and there was that apparently effects CMT without arthritis to the nerves causing pain. So FWIW info I wrote her back and what I found but will look into it further. She said maybe big pharma would recognize it if they could find away and make a gazillion dollars.

I wonder why this is passed down through generations and accepted as such… Weather change. they know rain is coming.. but never mentioned in any medical classes! Maybe it’s not on the top of the list of big pharma.

When barometric pressure drops, pain can increase because the reduced air pressure allows tissues around joints, like muscles and tendons, to expand, putting pressure on sensitive joint areas and potentially irritating nerves, leading to a perception of increased pain, especially for people with pre-existing joint conditions like arthritis.

-

Tissue expansion:

Lower air pressure means less force pushing on the body, allowing tissues around joints to expand slightly, which can irritate sensitive nerve endings.

-

Joint fluid changes:

Some theories suggest that a drop in pressure can affect the fluid within joints, making it thicker and potentially more prone to causing discomfort.

-

Nerve sensitivity:

Changes in pressure can stimulate nerve endings, sending pain signals to the brain.

-

Impact on existing conditions:People with conditions like arthritis are particularly susceptible to experiencing increased pain when barometric pressure changes due to the already inflamed state of their joints.

Maya 20:22

Yes another thing is child bearing woman I believe should start calcium and vita D for saving bones and teeth and keep them up or at least their prenatals if nursing and drawing more calcium. Also know what beverages drain it. They need at least light weight bearing exercise rest of their life and calcium and vita D. The D helps the immune system that apparently also helps fight against different cancers. If the bone cannot make the different kinds of blood cells there can be trouble including blood cancer or one of the ways to get it. So yes bones affect health. Plus porous bones are more fragile and also can cause pain as like in the back.

Those with a more sedentary life style need to compensate with weight bearing exercise and all need to help replace calcium and vita D. One doctor at work told me when something was going around and we had to close off a floor I mentioned vita D and sun with elder patients many years ago and vita D supplements during flu and RSV type outbreaks. He didn’t think that sun alone was sufficient for seniors because he felt that they we no longer absorbing and manufacturing enough vita D or getting enough sun. He believed in supplements and would check their levels. One of the rarer doctors at the time and he was from India but still not the same as others from there. More like DYODD. More are now. They should as even kids aren’t getting enough sun, their on computers and games.

My daughter is in a bad way right now since the accident but luckily is on the right medicine now with cultures but they had to remove a couple of screws in leg plates because pus was coming out. Osteomyelitis: She was at risk for osteomyelitis with open fractures and hardware. I still haven’t found out if they put antibiotics along the bone during hardware placement and if it’s titanium or stainless steel and they can’t take the hardware out yet. So external fixation not a option. Stainless steel is more prone to infection than titanium. They should of been watching that closer. Now one of her medicines your not supposed to take dairy products. Don’t that figure. This has been some wild ride and not over yet.