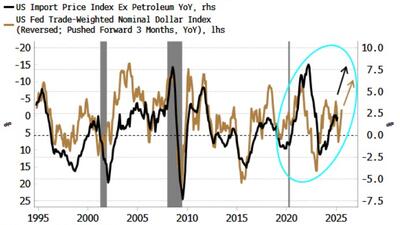

I can’t read the article either, but a lower dollar has many facets. Yes, it makes your exports cheaper, but it makes your imports more expensive, Stellantis are saying tariffs will add $5,000 per vehicle because of the volume of parts made overseas so in addition to tariffs they’ll be paying a currency premium too – a lower dollar is price inflationary.

The USD is supposed to be the reserve currency. To be relevant a reserve currency has to be strong, it’s pretty much the definition of a reserve currency! A reserve currency is used for international trade, international currency reserves, acquiring US treasuries as another form of currency reserve; it’s a matter of national pride too. Trump’s risking the reserve currency status here, playing directly into the hands of the Chinese. Especially if they devalue the Yuan themselves as a reaction to tariffs after the USD devalues, Trump can hardly point the finger at them for trying to race him to the bottom.

As the USD weakens, at what point does it reach a Minsky moment when hitherto USD lovers say “hang on, how much lower can this thing go? What’re ‘loose cannon’ Trump’s plans here? Our USTs are falling in value every day as shown by the increase in yields. Should we sell now, particularly as we have that basis trade thingy hanging over yields too?”. Because the USD isn’t backed by anything. The Aussie is backed by commodities – high demand for coal and iron ore (hello China) higher AUD. Norwegian and Middle Eastern countries likewise with oil. America? Armaments to a certain extent, Boeings, debt, but no definable backstop for the USD.

What exports will actually benefit from a lower dollar? What do you export nowadays anyway? We see American foodstuffs on our shelves like almonds, and maybe bacon, but we also have almond growers here too and we will always buy Australian given the chance – we definitely don’t buy Chinese, and if the country of origin isn’t actually stated then we don’t buy. In Oz, COO must be stated but there’s loophole whereby they can say, on ham for example, “Australian content <27%” (which always makes me laugh, how can a pig be 26% Australian and 74% somewhere else!) without specifying where the balance comes from. No deal from the ferrets. Sure we don’t mind buying American, but we don’t see it often.

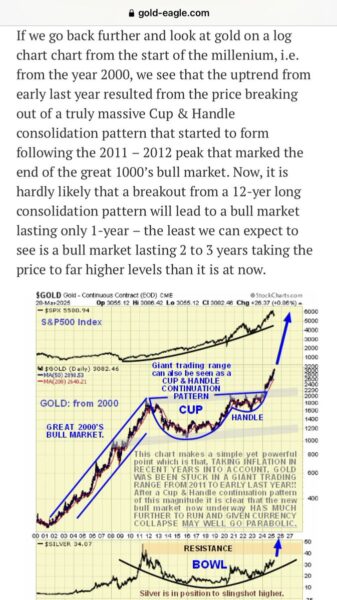

But. as you say, none of the above is negative for gold. Just the opposite.