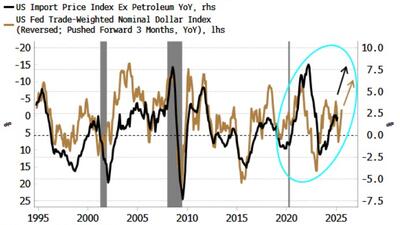

but I believe it’s an important point in that a weaker dollar will offset the tariffs by making our goods more affordable overseas.

China has been getting away with this for decades. I’m pretty sure the administration wants a weaker dollar as inflation cools, and they are getting both right now. The cog in the wheel for them is the Bond market. They definitely don’t want rates out of control.

I give it another week before Trump starts getting really loud and up in the Fed’s face about lowering rates by any means necessary. Probably QE.

Don’t think any scenario at the moment is bad for our metals though.

…stronger currencies in other countries gives the administration a convenient off-ramp to soften still onerous tariffs further.