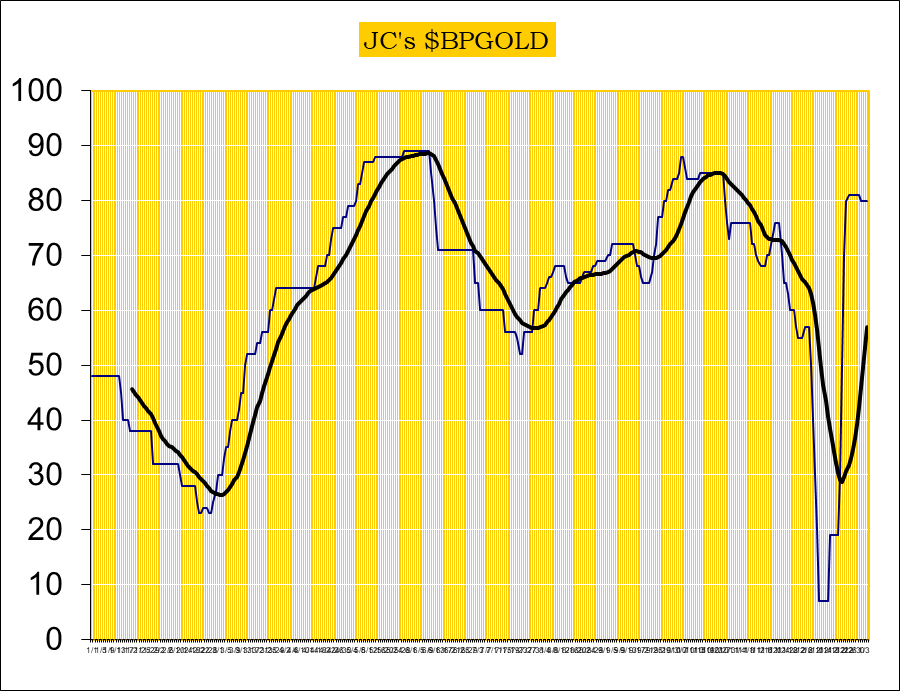

To public readers of our updates, our cycle indicator is one of the most effective timing tool for traders and investors. It is not perfect, because periodically the market can be more volatile and can result in short term whipsaws. But overall, the cycle indicator provides us with a clear direction how we should be speculating.

Investors

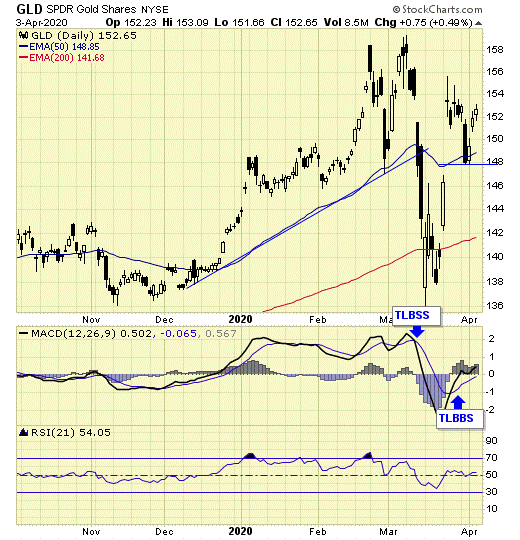

During a major buy signal, investors can accumulate positions by cost averaging at cycle bottoms, ideally when prices are at or near the daily 200ema.

During a major sell signal, investors should be hedged or in cash.

Traders

Simply cost average in at cycle bottoms when prices are at or near the daily 200ema; and cost average out at cycle tops when prices are above the daily 50ema

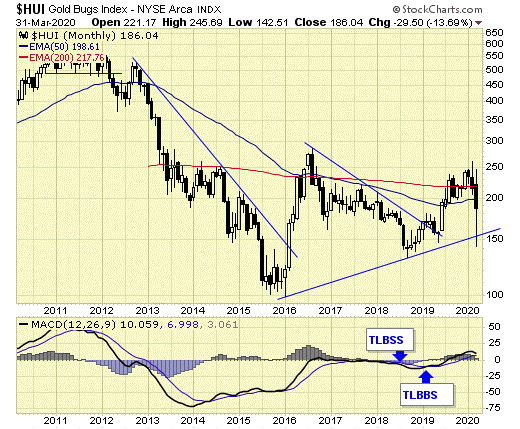

Gold sector remains on long-term buy at the end of March

GLD is on short-term buy signalGDX is on short-term buy signal.

XGD.to is on short-term buy signal.

GDXJ is on short-term buy signal.

Major support and resistance, with a median price are now established for trading the GDX.

Summary

Long-term – on major buy signal.

Short-term – on buy signals.

Gold sector cycle is up.

We are holding a core position, and also trading the short-term with GDX.

https://www.gold-eagle.com/article/gold-price-exclusive-update-shows-sector-cycle-sky-rocketing

Our proprietary cycle indicator is up, rising vertically from the lowest level in years.

Our proprietary cycle indicator is up, rising vertically from the lowest level in years.