Oro, I was getting the Dinesletter when a mail gram came to my front door. In June 1982 Dow at 796. It said…”Mr Dines recommends selling all inflation related assets, and move into the Dow at 796.” He also predicted a deflation in labor costs due to the use of foreign labor. He was one of the first to use technical analysis charting. He was fired from his job for recommending miners when Silver was .92 cents and Gold at $35. May have been late ’50s or early ’60s. I read his book the “Invisible Crash” from 1975 I think. The story was if you didn’t go up and prices stayed flat, it was the same as a crash. Like wages that don’t keep up with inflation. In my area even the houses were flat 1968 to 1982. The poor slob that bought a house in 1968 on the highs, took a beating if he sold in 1982, after paying all the interest payments maintenance and property taxes. Rates were going up 5% to 18% on loans 68-82. The guy that bought that house in 1982 and sold in 1988 won the lottery as interest rates were dropping after 1982.

Story:

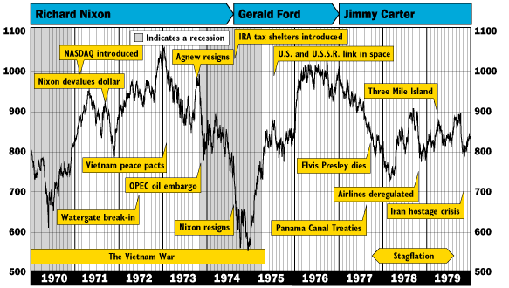

Not long after the industrial average punctured the 1000 mark, a recession occurred and the brutal bear market of 1973-74 set in, pushing the average all the way down to 577.60 in December 1974. It would be late 1982 — a full decade after the 1000 milestone was first passed– before the industrials rose above 1000 to stay.

Dow 1000: Finally in ’72

Cheers rang out on the floor of the New York Stock Exchange when the Dow Jones Industrial Average crossed the 1000 mark on Nov. 14, 1972.

If ever there was a psychological barrier for the Dow industrials, ”Dow 1000” was it. The average had knocked on the door of 1000 repeatedly for six years, but could never close above that ”magic” level.

For example, the industrials closed at 995.15 on Feb. 9, 1966, and at 985.21 on Dec. 3, 1968. There were also close calls in May 1969. But no cigar — until the euphoria of 1972.

Many investors active today will remember 1972. Richard Nixon was president, ”The Godfather” was packing them in at the movies, and Americans were tuned to ”All in the Family” on television. The Watergate scandal, which later destroyed the Nixon administration, was only a cloud on the horizon. The Vietnam War was a major problem, but on the day the 1000 barrier fell, North Vietnam had agreed that its representative would meet with U.S. negotiator Henry Kissinger for a new round of talks aimed at ending the war.

The re-election of Mr. Nixon over George McGovern had occurred a week earlier. And the economy was doing well. Economic growth was unusually strong, inflation was moderate and interest rates were low.

In the stock market, it was the heyday of the ”Nifty Fifty,” stocks that were so popular that it was said they were ”one decision” stocks: Buy them, and never worry about selling. Among the most popular stocks of the day were Xerox, Avon, IBM and McDonald’s.